A lack of awareness across the UK’s rental market could mean some landlords find themselves with ‘unrentable’ properties after 2025.

In new research from Shawbrook Bank, as many as 15% of landlords are unaware of any upcoming changes in legislation surrounding energy performance certificates (EPCs) in their rental homes. The survey showed that it was in fact the more experienced landlords that had been in the business for longer who had the least knowledge.

A quarter of respondents in Shawbrook’s study said they had little to no knowledge of the changes. But the new rules surrounding the energy efficiency of rental homes could affect thousands of UK landlords. Around 36% of current landlords rent out properties built before 1940, and older homes will need the most work to get them up to scratch.

What landlords need to know

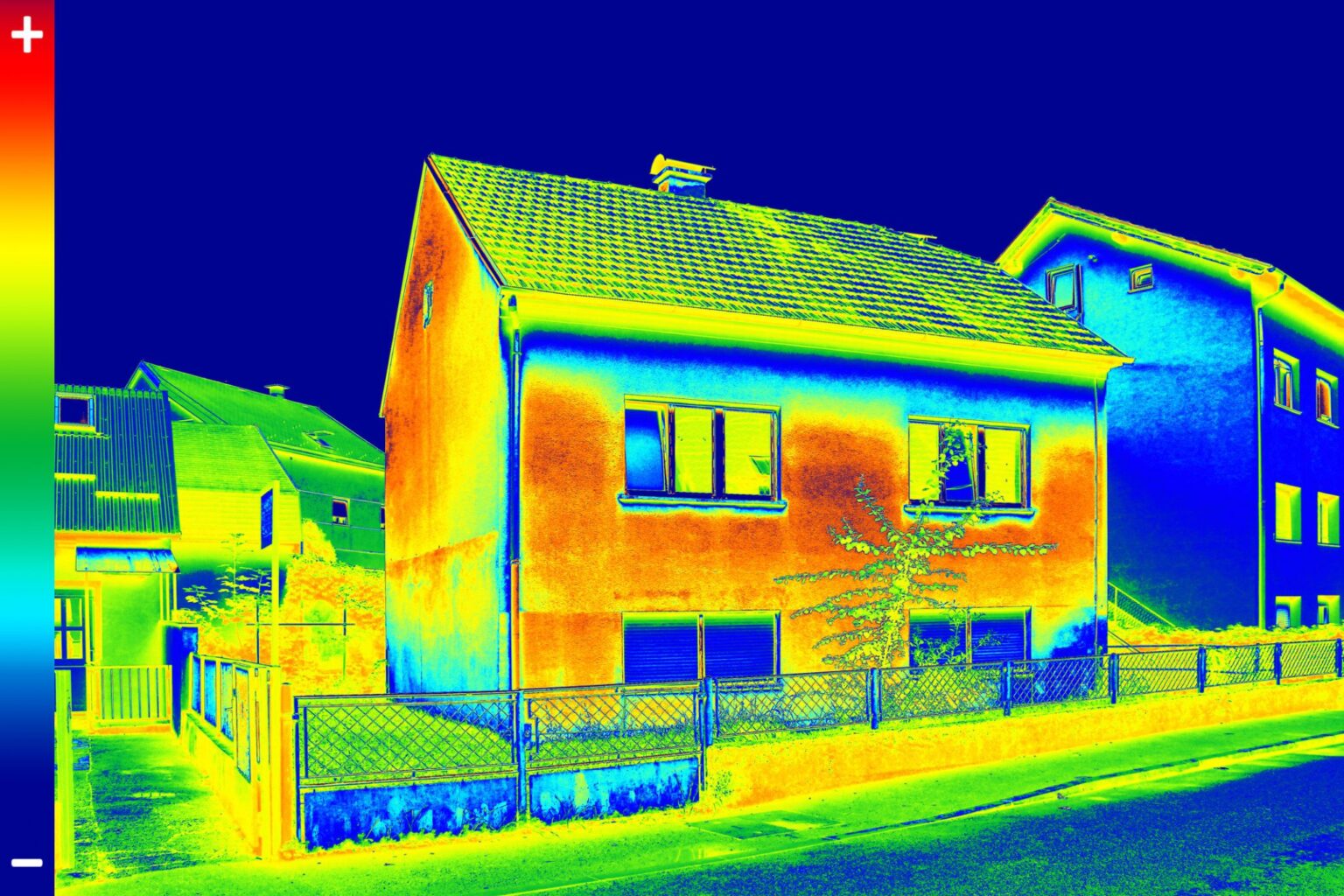

At the moment, if you rent out a property in the UK, it must achieve an EPC rating of E or above. This is a grade given to show how energy efficient a home is, with A being the most energy-efficient.

There are exemptions, such as if the cost of making even the cheapest recommended improvement would exceed £3,500 (inc. VAT). You can read more about this on the government’s website.

At the moment, the government is discussing plans to update legislation (the Minimum Energy Performance of Buildings Bill), which would see the minimum EPC rating raised to C from 2025. With the government’s targets to achieve net zero emissions by 2050, it seems highly likely that some form of rule change will go ahead.

Landlords whose properties fall short are therefore being advised to look into how they can improve their energy ratings in preparation.

Landlords could be exposed

Homes were responsible for 15 per cent of the UK’s greenhouse gas emissions in 2019, according to the latest available figures from the Department for Business, Energy and Industrial Strategy.

Upgrading rental properties will improve the overall energy efficiency of the country’s housing stock, says Emma Cox, sales director at Shawbrook Bank. It will also ensure that properties remain “commercially viable” for landlords.

“Putting off making necessary changes could leave landlords exposed to extended void periods when their property can’t be rented out while works are being completed,” she adds.

“Our research indicates a clear gap in landlord’s understanding of how the changes will impact [landlords] and their current yields. As well as these risks to landlords, renters may also be put in an even worse position as they compete for a smaller number of properties that are rated C or above after the 2025 deadline.”

Cost of ‘decarbonising’ period properties could reach billions

Across the housing market, specialist lender Together has revealed new figures that show the full extent of the issue. It estimates that decarbonising the country’s pre-1900s homes could cost £6.4bn by 2050.

While most owners of period properties (79%) say they know they need to make changes to improve their energy efficiency, more than half (57%) don’t know how. And a fifth (21%) of period property owners are unaware of the need to adapt their homes in order to reduce their carbon footprint.

Scott Clay of Together says: “England has some of Europe’s oldest housing stock and is well-known for its high concentration of period homes, and while this is a gift for house-hunters and property investors, it can be a curse when thinking about carbon emissions.

“What’s clear from our survey is this glaring awareness gap between period property-owners who know there is a problem and those who know how to fix it. There is no overnight solution, but there are methods to help turn the tide. More needs to be done to help those living in older houses understand what carbon neutral changes are feasible given their budgets.”

Investing in a new-build property is one of the best ways of ensuring your rental property is set up to achieve the highest EPC ratings in the future.

BuyAssociation specialises in off-plan, new-build and newly converted investment properties direct from the developer. Get in touch for more information, or browse some of our opportunities.