A new report released by Savills explores some interesting trends in the UK housing market. It also reveals the latest predictions across renting and buying.

Over the first 15 years of the 2000s, the number of private rented households in England more than doubled. Meanwhile, mortgaged homeowner numbers dropped by around 1.5 million. Homeownership stopped being a top priority for young people, with affordability as well as an abundance of rental housing both contributing.

For the past five years, the levels have remained largely the same; homeowners and private rented tenants are closer in number than ever. The Savills report, titled Changing drivers of tenure, looks at the reasons behind this plateau, and what factors may influence future market shifts.

More help for homeowners

In September 2019, there were around 8.43 million mortgaged homeowners in the UK, according to the Labour Force Survey. This is a fall of 1.53 million since 2000, although is a slight rise of 340,000 from 2016.

This is influenced by two major factors: a relatively recent influx of first-time buyers, combined with less people at the other end of the scale paying off their mortgages.

According to UK Finance, there has been more than 350,000 first-time buyers per year over the past few years. Back in 2013, this number was below 260,000.

One thing that has changed is the amount of government help available to buyers now. The Help to Buy scheme had been helping an average 40,000 first-time buyers a year onto the housing ladder in England, for example. Lenders had also been offering higher loan-to-value mortgages.

Bank of Mum and Dad

The report points out that the way deposits are funded now compared to 20 years ago has also changed. There’s been a major rise in support from the “bank of Mum and Dad“, as well as help from grandparents. For many, this may be the only way of getting onto the housing ladder.

It adds: “In all likelihood this has now become an entrenched means by which people graduate to home ownership. But in the short term, the falls in the stock market and the knock-on impact this may have on older households’ pension provisions may curtail its availability.”

According to the English Housing Survey, 34.4% of first-time buyers get a family gift or loan towards their deposit. The reason this may be more common now is because the older generations tend to have much more property wealth due to a strongly performing housing market and rising prices.

Changes in the private rented sector

There are now approximately 4.55 million households renting privately in the UK, says the report. This is around double what it was in 2000, despite a fall of around 240,000 since 2016. However, there is one age group in particular that stands out in the sector.

“Despite the increase in first-time buyer activity, private renting has continued to increase and mortgaged owner occupation fall in the ‘lost generation’ of 35-44-year-olds,” says the report.

This demographic is now more likely than ever to be looking to rent rather than buy, overtaking the traditionally ‘young’ renting population.

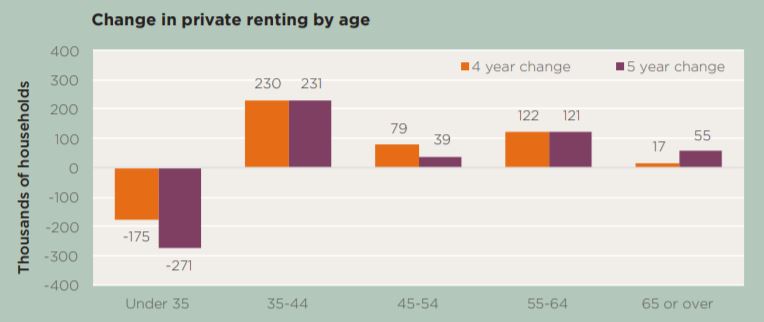

Savills has also published a graph, produced by the English Housing Survey, showing how all age groups fit into the bigger rental picture.

The chart demonstrates how renters in the under-35 category have reduced. However, in all other age groups, and particularly 35-44-year-olds, the numbers have continued to rise over the past five years.

Growth in build-to-rent

Traditional buy-to-let is still a sought after accommodation option for many. However, along with a rise in city centre and urban living has come a boom in the build-to-rent sector.

At present, the report points out that build-to-rent homes make up just 1% of the private rented stock in the UK. However, Savills believes the sector has the “capacity to increase in scale from £10bn today to £550bn at full maturity”. There are currently around 40,000 completed build-to-rent properties, with 36,000 under construction according to BPF.

For tenants who are increasing in age, with potentially greater budgets and higher expectations from their rental homes, build-to-rent is an ideal solution. They tend to be large, purpose-built blocks which are professionally managed. They also offer added amenities such as a concierge, communal areas, gyms and outdoor areas. Location-wise, they are normally situated in areas of high demand either in city centres or close to excellent transport links.

For property investors, the predicted boom in the build-to-rent sector is something to be aware of. Due to their high demand, they can offer better yields than a traditional buy-to-let house. Often attracting institutional investors, there are a range of hands-off investment opportunities available across the UK.

At BuyAssociation, we can help you find the best property investment for you, including in the build-to-rent space. Sign up for free and we can send you options tailored for your needs, or get in touch directly for more information.