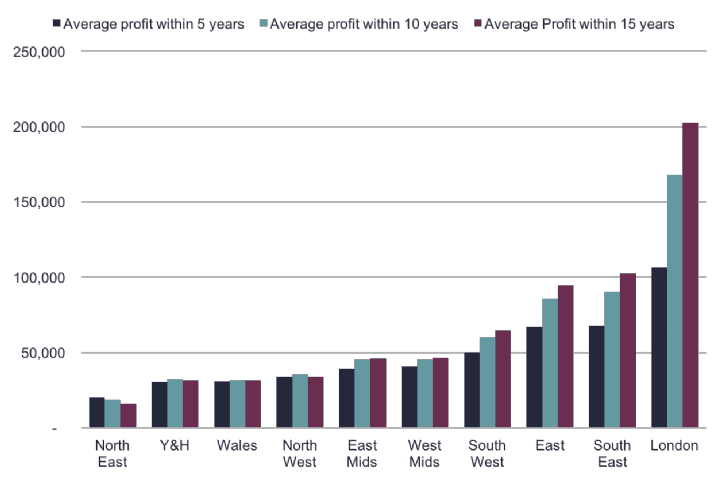

The report released by Savills on the 26th February, highlighted the fortunes of buyers over the past 15 years. Showing the importance of timing and location when it comes to the UK property investment market.

Using data from the Land Registry, the report revealed over half the buyers who sold property in England and Wales last year had purchased within the 15 year time-frame, with an average profit returned of £73,127.

Surprisingly, those who profited the most (average of £98,378) were the savvy investors were brave enough to invest post financial crisis in 2009. Largely against the backdrop of negative media sentiment and tough market conditions. Taking advantage of the favourable market conditions for active buyers.

The author of the report, Lucian Cook was quoted in the Financial Times, indicating that a 2009 purchase would have been “more luck than judgment”. “The mortgage markets were locked up, but I also suspect some of this is about whether people were brave enough to do it and whether some people in 2009 had enough accumulated equity at that point to be able to make the move.”

Avg. Profits by regions over 5, 10 and 15 years.

Source: Savills

What does the future hold for property investment

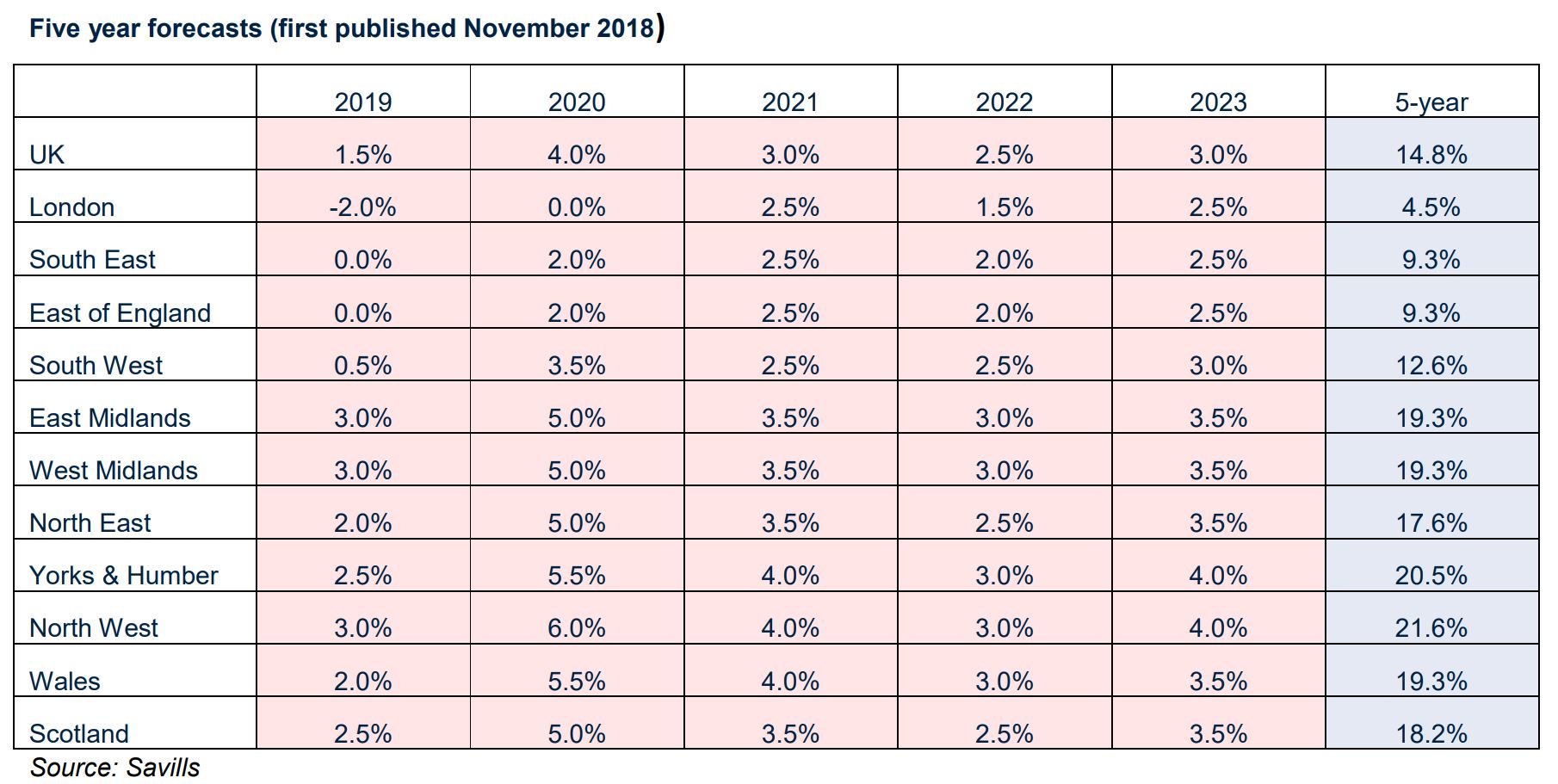

The Savills report continues to outline their current 5 year forecast for house prices. Suggesting a reversal of the North-South divide, with housing prices in the North of England and Midlands set to outperform London and the South. With a predicted 21.6% growth in the North-west and 19.3% in the Midlands.

Our experience at BuyAssociation, from working with developers and property investors for over 14 years, including the 2008 financial crash, really supports these findings. Getting the timing of “when” you enter into a investment, can be just as important as the exit. But relying on luck alone, is not necessary. In the long term, property investment in the right place at the right time will continue to offer strong returns.

London has seen huge growth, but its now to time to look north. Especially in emerging regional cities such as Birmingham, Manchester, Leeds and Liverpool. Which continue to offer strong rental yields and demand for new housing. At stamp duty friendly price points, considerably below equivalent purchases in London and the South. There are a number of strong options in the market at present. Especially for cash rich buyers.

Source: