Knowing which locations might give a better return on an investment is vital when mulling over a property option.

Buying to rent out to students is a popular choice, and new figures from Totally Money have revealed that many of the country’s highest yields from buy-to-let are to be found in postcodes in towns and cities with universities.

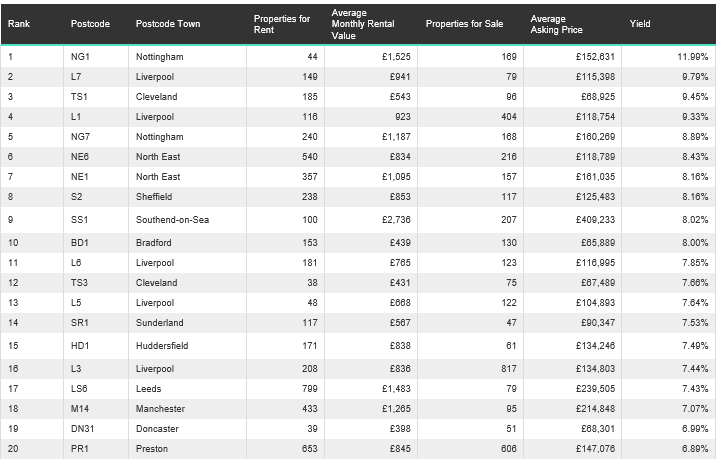

And Totally Money’s top 20 reveals that properties from the East Midlands northwards bring the best returns, with only ninth-placed Southend-on-Sea outside that area.

Healthy rents by the Trent

NG1 in central Nottingham tops the list a yield of 11.99%, although there are just 44 properties rented out in the postcode, where there’s an average rental value of £1,525 per month. However, NG7 is fifth on the list at 8.89%, indicating a strong market for renting to students at the universities of Nottingham and Nottingham Trent.

Liverpool, recently named as one of the most appealing buy-to-let markets in the UK, also performs well in the new figures. A quarter of the Top 20 postcodes are in the Merseyside city, and L7, which includes Edge Hill, Fairfield and Kensington returns an average rental yield of 9.79%. In Manchester and Leeds, the traditional student areas of Fallowfield and Headingley respectively still perform strongly with figures of over 7%. Recent figures from all three cities showed around 80% of students in each were happy with their accommodation choice.

Other places in the top 20 with large student populations are Newcastle, Sheffield, Bradford, Huddersfield and Preston. The latter was named as the UK’s most improved city to live and work in by PwC, and as well as an expanding student population, it is now seen as a base from where Liverpool and Manchester can be commuted to.

Students keen to secure accommodation early

Investors should bear in mind that competition for good accommodation is hotting up in student-centric locations. A recent study by Which revealed that a quarter of students start looking for their next academic year’s accommodation by the end of November of their first term.

With graduates often inclined to stay where they studied once they start working, and with young professionals attracted to areas with strong student demand for facilities and lifestyle reasons, forward-thinking investors may want to consider this new data when considering these markets.

Research produced by TotallyMoney.