The UK’s transition plans for the period after Brexit on 29 March 2019 have just been published, but how our exit from the European Union will affect the country remains to be seen and the uncertainty is a worry for some investors.

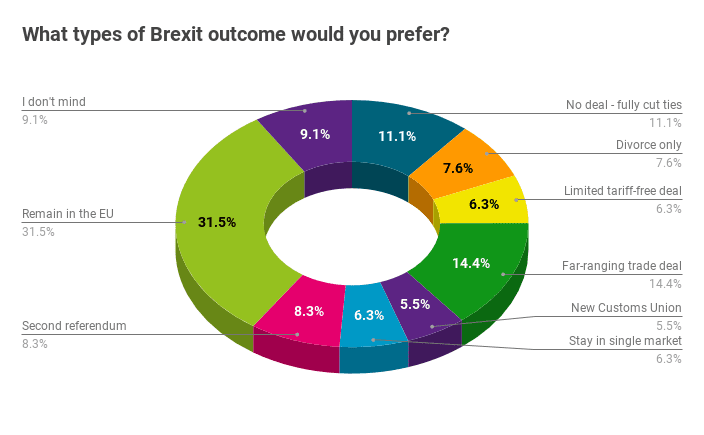

In BuyAssociation’s first annual survey of investors for 2018, 30.4% of respondents named Brexit as their greatest concern for the year ahead. When questioned on what type of Brexit outcome would be preferred, the majority of respondents – 31.5% – said that to remain in the EU would be the desired result, while 14.4% said they hoped for a far-ranging trade deal.

Potentially in relation to the impending Brexit agreement, a fall in house prices was the next top concern for 13.79% of investors, despite last year’s steady annual climb of around 5.2% across the UK, according to Land Registry data. Predictions about how Brexit will potentially affect house prices are rife, and though London has seen a general flattening of the property market, other parts of the rest of the UK, particularly in the north-west and West Midlands, are expected to see strong growth.

The chart below shows that a wide range of views are held by investors surrounding the issue of Brexit, with 11.1% hoping for a no-deal situation, while 8.3% would like a second referendum and 6.3% want to stay in the single market.

Government instability and increased stamp duty were also high on the list of concerns for investors, singled out by 8.3% of survey respondents. Property investors have to pay a 3% surcharge for every additional property purchase they make, and although this tax has now been in effect for almost two years, it still affects buy-to-let landlords’ bottom lines and makes choosing the right investment property even more vital.

Sam Hadfield, managing director at BuyAssociation, said: “The results from our investors does not surprise me. Brexit is a big deal, it does bring in uncertainty, and uncertainty should always narrow the focus.

“However, I do not see Brexit on its own impacting any of the fundamentals that are driving the property markets or change evolution of the demands of today’s tenants. We’ll still see an increasing appetite for city living that is not being met, and we’ll still see demand rise as it continues to outstrip the delivery of new housing stock.

“The outlook for property remains positive, just narrow your focus and manage your risk, don’t over leverage, and buy well.”

Download the report today and discover the plans investors have in store for their portfolio, the locations they’re looking to buy in, and the asset classes that are appealing to industry experts.

[gravityform id=”8″ title=”true” description=”true”]