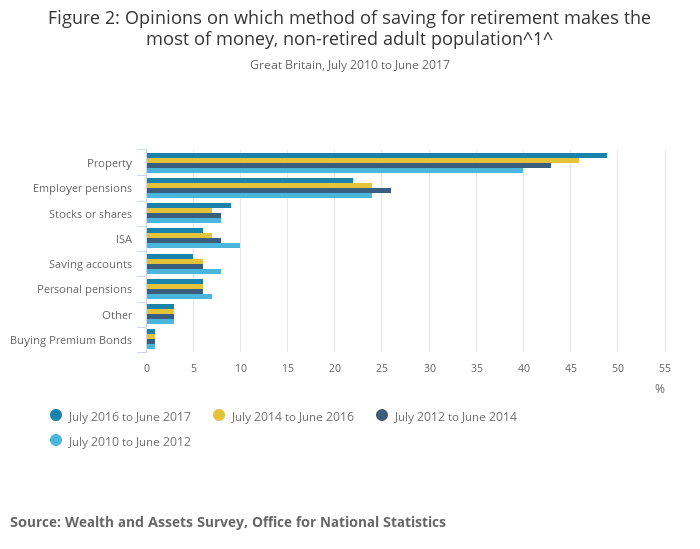

People of working age can save up for retirement in a variety of ways, but almost half of the UK population believe that investment in property will provide the best pay-off.

The Wealth and Assets survey by the Office for National Statistics (ONS) has revealed that 49% of non-retired UK adults chose property as the most sound investment choice for maximising your finances, making it consistently the most popular investment option since 2010.

Employer pensions were the second most popular choice, with 22% of non-retired adults between July 2016 and June 2017 putting it as their top option, followed by stocks or shares with 9%, ISAs with 6% and savings accounts with 5%.

The ONS said: “Since July 2010 and continuing into the latest period of July 2016 to June 2017, the percentage of people identifying property as making the most of their money has been increasing, which may reflect a growing confidence in property prices over this period.”

Despite the difficulties faced by more buy-to-let landlords in recent years, the proportion of people who still put property as the top investment option has grown by 9% from 40% back in 2010-2012.

Nathan Long, senior pensions analyst at Hargreaves Lansdown, said: “The Government’s attempts to make buy-to-let investing less attractive have done nothing to dim the attraction of property as the best way to make most of your money.”

A safe bet

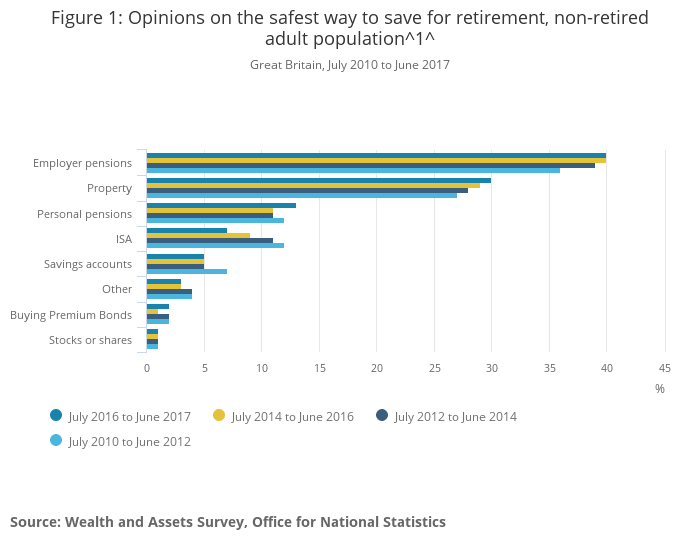

In the same survey, participants were also asked to identify what they considered the safest way to save up for retirement, and property came second on the list, chosen by 30% of people. Employer pensions took the top spot with 40% of the vote, while personal pensions were picked by 13% of people and ISAs got 7% – a significant reduction on the 12% seen in 2010-2012.

However, the scores indicate that perspectives might be changing, as the percentage of people opting for employer pensions remained the same from July 2014-June 2016, whereas the number of people choosing property as the safer option has continued to increase since 2010.

What this tells us is that attitudes towards property investment remain largely positive across the UK and the asset class is even gaining in popularity as other forms of savings and investments continue to offer only small gains for many investors.