Thinktank Resolution Foundation reveals that within a decade 90% of people living in the UK, aged under 35 years and on modest incomes won’t be able to leave paying rent behind and afford home ownership.

The thinktank had a closer look into the rise of property prices and published its forecast recently.

Whilst an all-party committee of MPs described the housing policy as “a mess”, the Resolution Foundation described those aged 18 to 34 as the generation: forever rent and furthermore increasingly explained home ownership as the domain of the well-off and elderly.

The thinktank, chaired by former Conservative cabinet minister David Willetts. stated that 18 years ago, in 1998, the majority (more than half) of people aged 16-34 living in households with incomes between 10% and 50% of the national average were buying their own houses. IN 2013-2014 this percentage had dropped to 25% and is now on course to be 10% across the UK by 2025. In the capital the forecast is even lower, at 5%.

Matt Whittaker, chief economist at the Resolution Foundation, said: “With the average modest income household having to spend 22 years to raise the money needed for a typical first time buyer deposit – up from just three years in the mid-1990s – it’s no surprise that owning looks so out of reach.”

Chancellor Osborne announced bold action to fight Britain’s housing crisis in last November’s autumn statement, including a doubling of interest-free loans in London, a tougher tax regime for buy-to-let investors and a pledge to build more affordable housing.

However, in its report on the autumn statement, the Treasury select committee made some harsh remarks about the chancellor’s approach, saying that restricting buy-to-let investment present a threat to labour mobility and growth.

“The chancellor’s attempts to resolve what he calls a ‘home ownership crisis’ should not come at the expense of the private rented sector”, MPs said. “Housing policy in the UK has been in a mess for a long time – caused by the policies of successive governments over decades, and, often, their unintended consequences. Sooner or later, more thoroughgoing reform will be essential.”

In Whittaker’s opinion both David Cameron as well as Jeremy Corbyn were failing to grasp the problem at its root: the need for a house-building programme that would increase the supply of new homes to meet growing demand.

“If we want to see an increase in working families being able to afford to buy, it is essential that the housing shortage is tackled by the government.”

He then went on saying schemes like Help To Buy, which offer cheaper mortgages subsidised by the state, only helped a minority and assisted those who would’ve eventually made their way onto the property ladder regardless.

“More than half of those benefiting from Help to Buy to date have household incomes in excess of £40,000. It is hard to imagine any way out of the home ownership crisis facing those on low to middle incomes that doesn’t involve significantly boosting supply,” Whittaker said.

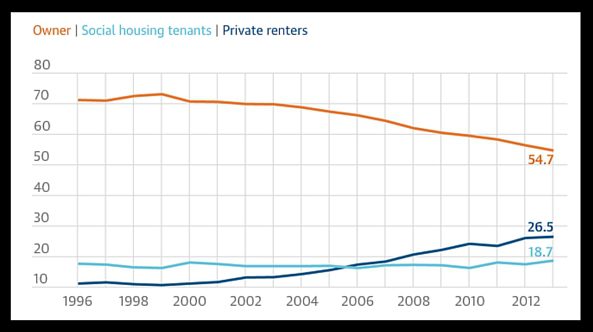

For its study the Resolution Foundation used data from the family resources survey conducted by the Department of Work and Pensions. The thinktank found an overall decline in home ownership, whilst private renting more than doubled amongst young people and had been predominantly evident for those on low to middle incomes, nine out of ten of whom were employed.

In 1998, 22% of the under-35-year-olds on modest income were renting, this number went to 53% recently.

The survey also found that 76% of landlords explained their reluctance to let property to those aged between 18 and 21. A result of the decision to prevent this age group from claiming housing benefits. As a reason for their decision, landlords named the fear that tenants of that age bracket might be unable to pay the rent.

The RLA also said the under-35s may also face difficulties accessing rental accommodation in the future. Following the new rules, they’re only able to claim benefits for a room in a shared house and 53% of landlords stated they did not intend to renew such tenancies because of fear about payments not being made.

Chris Town, the RLA vice chairman, said: “The results confirm that reforms to housing benefit are making it increasingly risky for landlords to rent to those receiving it.”

The analysis by Resolution Foundation registered that the age bracket of 65+ now accounts for almost 33% of all homeowners, a significant increase from under 25% in 1998.

To put this in contrast, those aged 35 and younger account for one-tenth of homeowners, down from almost one-fifth in 1998. The average 30-year-old is also 30% less likely to own a home than they were 15 years ago.

Torsten Bell, Resolution Foundation director, said ministers were “trying to push water uphill. What they need to do is build more houses.”

Source: The Guardian