The Birmingham property market is driving forwards after it recorded the highest number of property sales in the UK in the first quarter of this year.

Across the UK as a whole, property sales were down during the first three months of this year compared with the first quarter of 2022. According to new data revealed by Nested, using Land Registry figures, a total of 76,489 sales completed during the period – down by 58% year-on-year.

While this was not wholly unexpected, being a result of both the turbulence at the end of 2022 slowing the market, as well as the rush to buy during the previous period thanks to the government’s stamp duty holiday which created a surge of transactions much higher than previous years.

However, not all areas have experienced the same decline, with the housing markets in certain local authorities in England and Wales bucking the trend and showing a much stronger level of performance and market activity. Birmingham recorded a standout 1,070 completions, making it the leading location in the UK.

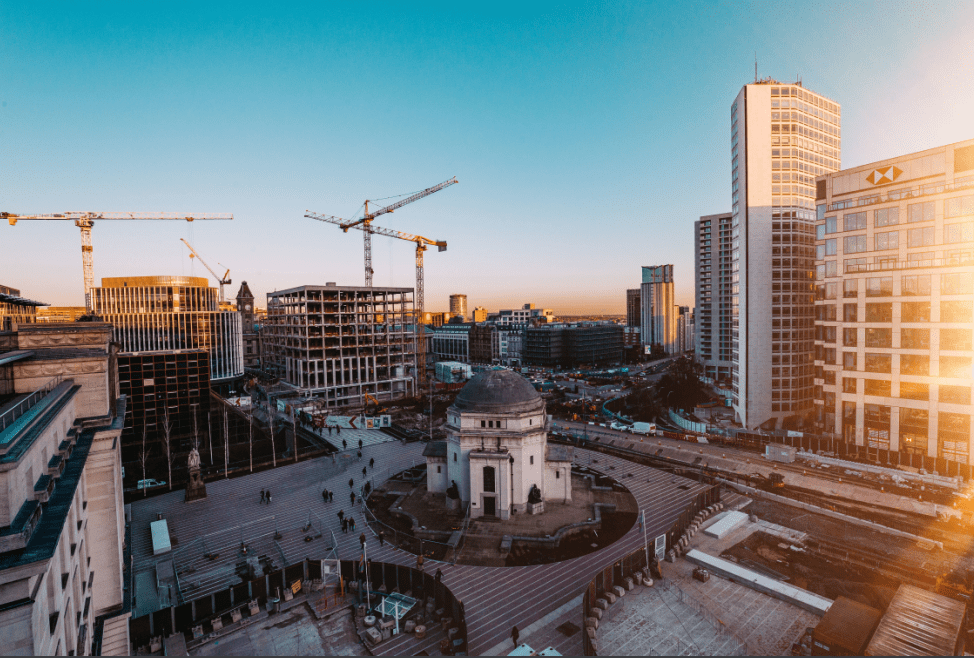

Birmingham as a top investment location

Strong transaction activity indicates that not only are there plenty of properties coming to market, meaning sellers have confidence, but also that buyer demand and follow-through is high. Birmingham is benefitting from a high level of regeneration, which is bringing plenty of new homes to the market to meet the demand.

Birmingham was also recently listed as one of the UK cities that was experiencing higher than expected house price rises, according to a report from Purplebricks. Property prices increased by 1.4% in March in Birmingham, above the UK average, and the average value there is now £279,920.

On an annual basis, Birmingham also recorded the second strongest house price growth in the UK in Zoopla’s index for March, with a 6.1% average year-on-year price rise. This was followed by Manchester with a 5.8% increase, and Leeds with 5.4% growth over the past year.

Vincent Courtney, chief sales officer at Purplebricks, said: “We’d always expect prices to rise to a degree in March but the property markets in Birmingham and Leeds not only are out-performing the wider Northern Powerhouse, they’re outperforming our expectations.”

Uplift is expected

After Birmingham, the research from Nested lists the top five locations for property transactions between January and March in England and Wales as follows: Leeds (1,043), North Yorkshire (938), Cornwall (920) and Somerset (876).

The parts of the country that have seen the biggest falls in completed property transactions during the period are North West Leicestershire, with a 73% year-on-year fall, followed by Harborough (-70%), Anglesey (-70%), North Warwickshire (-69%) and Melton (-69%).

However, while each part of the country experienced a drop in housing market activity, there are positive signs on the horizon, as this year got off to a busy start in terms of buyer levels and an uplift in properties coming to the market. This means activity is expected to rise again over the course of 2023.

Alice Bullard, managing director at Nested, said of the findings: “The higher cost of living, increasing interest rates, a disastrous mini-budget and the resulting turbulence seen across the mortgage sector all had a significant impact on buyer demand levels during the closing stages of last year.

“While 2022 may seem a long way away now, what we’re currently seeing is the knock-on effect from this reduction in market activity, with the lower level of sales agreed now reaching completion.

“The good news is that the industry has widely reported an uplift in activity almost immediately in 2023 and so while we’re yet to see this materialise in terms of actual homes sold, we can expect to see an uplift over the coming months as these sales finally reach the finish line.”

BuyAssociation currently has some exciting property investment opportunities available in and around Birmingham, as well as other promising locations across the UK. Get in touch to find out more.