George Street

Altrincham, Manchester

George Street offers four luxury apartments in one of Manchester's most desirable neighbourhoods, Altrincham town centre

Price

£240,000

Gain access to exclusive buy-to-let investment opportunities at discounted prices with BuyAssociation.

Our team can connect you with the best deals on buy-to-let property investment opportunities and give you exclusive access to leading developments before anyone else. We work with portfolio landlords and institutional investors, identifying key opportunities that meet their criteria.

Investing in property can be daunting, but we’re here to make it easier. Our team of buy-to-let property specialists will guide you through the process of building a lucrative portfolio of buy-to-let properties.

We’ll help you find the perfect locations, negotiate with the sellers, and help you navigate the legal and financial requirements of buying property as an investment.

Our goal as an award-winning team of consultants is to locate properties that have the potential to produce strong yields and capital growth. By taking a consultative approach to best understand the needs, requirements, and property goals of our clients, we endeavour to ensure that the off-market properties we source exceed our investors’ expectations.

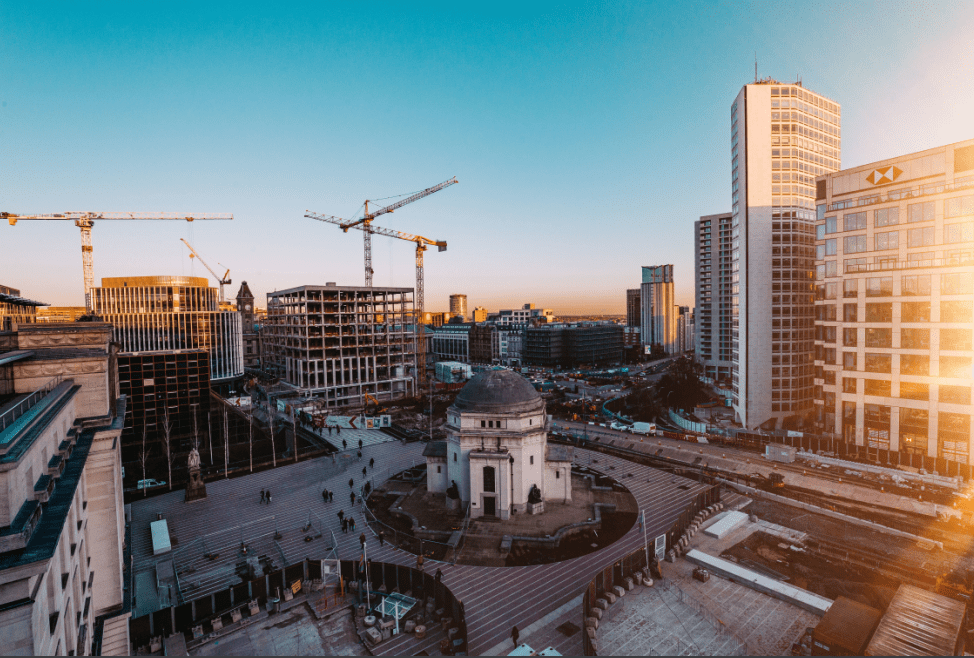

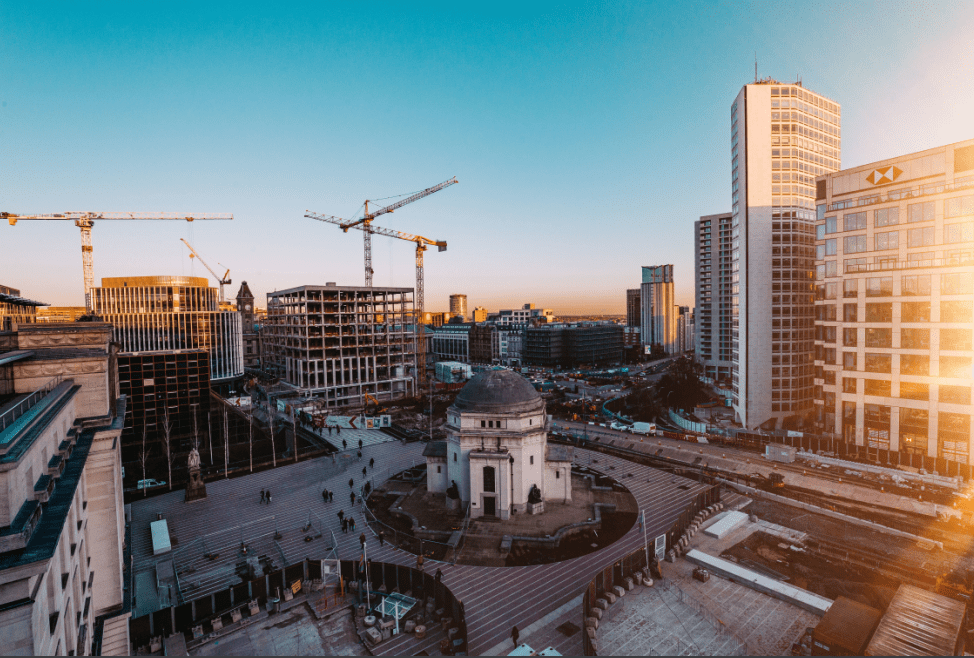

We operate across prime locations in the UK. With buy-to-let investment opportunities based in Manchester, Liverpool, Birmingham, Leeds, South Yorkshire, and more, we aspire to enable our clients to build or grow their portfolios in the most beneficial way.

To discuss your investment property goals, receive regular updates on exciting developments, and become part of our strong community of investors, contact our friendly team today.

In its simplest terms, a buy-to-let property is an asset which enables investors to gain long-term rental returns from tenants. Properties of this type produce rental income and capital gains, whereby the investor buys the property with the sole purpose of renting it to a tenant (or multiple tenants).

Typically, this investment type is identified as being highly lucrative – offering a potentially high return on investment and capital gain once the property is eventually resold. However, how you make profits on a rental property depends on your intentions and aims when purchasing the property in the first instance.

The broad umbrella of buy-to-let investment types includes standard residential homes, social housing, HMOs (houses in multiple occupation) and holiday rentals – all of which operate in slightly different ways and provide varying outcomes.

We work with property investors from around the world, sourcing opportunities from the best developers in the market.

Our unique position in the market allows us to connect investors with developers at the earliest stages of a buy-to-let development.

All of BuyAssociation’s buy-to-let investment opportunities are sourced completely free of charge for our investors, directly from the developer.

Property investment, particularly within the UK, is renowned for providing passive income, being versatile, controllable and stable. Property offers an element of flexibility, allowing investors to take direct control of their investment to fit evolving requirements and trends.

By carefully investing in buy-to-let property and building a strong portfolio, you can expect to benefit from long-term regular rental income, capital appreciation, and an abundance of potential tenants.

With research forecasts implying that house prices will continue to rise in the next 10 years, buyers who choose to invest now are most likely to benefit from capital gains when selling their properties in the next decade.

For landlords with property portfolios, finding ways to maximise rental yields is essential for long-term income. As it stands, average yields across the country are high, signifying the strength of the UK’s buy-to-let market.

Typically, the highest average yield for portfolio landlords is 6.7%, where single property owners can expect to earn an average of 5.4%. Recent records show that both the South West and North East of England are producing the highest returns for the private rented sector, with the South East and London trailing behind with the lowest yields.

However, there are particular locations across the region which boast higher success rates than others, which is why focusing largely on thriving cities is important when it comes to selecting the right buy-to-let investment.

Studies have shown that the price of homes in the UK has increased at a higher rate than in any other European country. As a result, the strengthening housing market has benefited millions of homeowners due to their properties increasing in value over the years.

According to Savills, their five-year house price forecast predicts that by 2024, the UK will see at least a 15% rise in property prices. In addition to rising house prices, the average rental cost is the highest it has ever been in the UK, averaging at £1,175 per calendar month. The surge in rental costs comes as a result of the increased cost of living, constant demand, and higher tax costs for landlords.

Over the past few years, private renting has gone from strength to strength, and the surge in tenant demand has not gone unnoticed. Many people living in the UK are unable to afford mortgages or secure their own homes, which is a huge contributor to the success of private renting.

Additionally, the increased requirement for homes combined with the under-supply of housing is driving more plans across the country to construct and develop residential projects to meet the demand.

With city-centre living growing in popularity, increasing numbers of young professionals looking to rent, and renting becoming more affordable than buying, there has never been a better time to make a buy-to-let investment.

One of the most positive aspects of buy-to-let investment is the ability to adjust and amend your investment as trends and markets evolve. With property, landlords can continue to invest in refurbishments, additional amenities, and upgrade facilities to meet the requirements of their tenants.

Additionally, investors possess the power to decide when, where, and how their property operates. From choosing the rental prices and deciding on an ideal tenant type to dictating the level of refurbishment carried out and how the property is managed, the property market gives investors the opportunity to direct their property portfolio to meet their specific requirements.

When done correctly and diligently, investing in buy-to-let can provide you with a regular source of income, increased cash flow and capital appreciation over time. This type of property is an incredibly popular choice with investors, as it is the only investment type which offers rental returns. However, to gain regular income from a BTL property, it is vital to consider the key metrics of what makes a successful investment property.

It is important to conduct research into the following factors as part of your decision-making process:

By taking into account these crucial elements, you will be able to judge the overall performance of buy-to-let properties in the different locations around the country. However, like any investment, there are inevitable risks to consider with buy-to-let properties. It is important to plan ahead to prepare for market changes, drops in demand and void periods. You should implement long-term strategies and gain the knowledge required to maintain the success of your investment and prepare for any hiccups that may occur.

Some additional elements to consider before securing an investment property that you intend to let are:

Once you have explored the most lucrative and successful locations to invest in, you can then begin to discuss your property investment goals with an experienced consultancy such as BuyAssociation. With our selection of off-plan buy-to-let properties in several prime locations in the UK, we aim to find the perfect property that meets your requirements.

If you’re renting out a buy-to-let property, you must oblige the landlord responsibilities laid out by the UK government.

As a landlord, your legal obligations include:

It’s important to check that you can deliver on each of these before renting out your buy-to-let property to avoid legal repercussions.

If you’re investing in a buy-to-let property, you will need to consider the different costs that are involved. One of the most major costs is stamp duty land tax (SDLT), which you will have to pay on any property purchased for more than £250,000 as of September 2022.

The current stamp duty rates are as follows:

Buy-to-let investors will also have to pay an additional 3% stamp duty surcharge on top of the standard rate, because the purchased property will not be your main residence.

You can use a stamp duty calculator to determine how much stamp duty you might have to pay on your buy-to-let investment.

Capital Gains Tax will have to be paid on any profit you make from the sale of your buy-to-let property. Capital Gains Tax for landlords is 18% for basic-rate taxpayers and 28% for additional rate taxpayers.

You’ll also need to consider buy-to-let income tax, which is a tax that must be paid on rental returns. As a buy-to-let property investor, you’ll need to declare any rent you receive in your Self Assessment Tax Return. The rate of income tax you have to pay will depend on the amount of income you receive.

Check the government website for guidance on buy-to-let taxes, and to find out in what circumstances you might be eligible for tax relief.

To manage a buy-to-let property with the strongest potential, it is absolutely essential to invest in high-growth areas with strong, consistent tenant demand. Developments that are placed in popular areas and located close to amenities, schools, transport links and business hubs make for extremely attractive investments. Well-located properties are most likely to boast strong returns and provide landlords with a regular income over time, particularly landlords with a large and diverse property portfolio. With the UK holding an ever-growing population and an increasing number of people looking for rental properties, investing in BTL properties has never been more advantageous.

The following cities offer some of the best buy-to-let investment opportunities in the UK:

At BuyAssociation, our investors gain exclusive access to fantastic discounts on the UK’s most exciting developments. When it comes to sourcing the right buy-to-let investment opportunities for our valued clients, we take a variety of important elements into consideration before distributing them.

As a skilled team of consultants with myriad qualifications, awards and experience under our belts, we know what comprises a valuable investment. Consequently, we utilise our expertise in helping investors across the region and overseas in securing suitable, prosperous buy-to-let investments.

Our careful approach to the investment process is what has led to our fantastic testimonials and what strengthens our relationships with developers and investors. Investors can enhance their collection with our portfolio of off-plan, hands-off and fully managed property investments in the form of buy-to-let, HMO, social housing and holiday let properties.

Whatever your investment goals may be, speak to us today and allow us to guide you towards your targets.

To find out more or to benefit from our exclusive investor community perks, contact us today on 0333 123 0320.

STAY AHEAD OF THE MARKET

We send limited and targeted emails on new launches and exclusive deals which best fit your areas. We are trusted by over 30,000 active buyers as their source for new stock.

Additional information

A buy-to-let is a property that you purchase with the sole purpose of turning it into a rental property. It can be a house, a flat or even a business premises.

When you buy a property to rent out, you are considered a landlord and you have certain legal obligations towards your tenants. You will need to take out insurance to cover any damage or loss that might occur while they live in your property.

You will be responsible for arranging repairs and maintenance, collecting rent from tenants, and managing any disputes that might arise between yourself and your tenants.

A buy-to-let mortgage is a loan that is secured against a property, which is then rented out to tenants. The property must be treated as a business and the lender will require the bank accounts to be separate from any other accounts.

Buy-to-let mortgages are most commonly used by landlords who are looking to invest in property for long-term rental profits. They are usually used by investors as they have lower rates of interest than residential loans but require a higher deposit from borrowers.

Buy-to-let mortgages can be used to purchase properties for both residential and commercial use.

The law requires landlords to carry landlord insurance in order to protect themselves and their tenants. This protection covers the damage you might cause to your property, or that of your tenants, as well as any injuries sustained by visitors to your property.

Landlord insurance is also a great way to protect yourself from lawsuits brought by tenants for negligence on your part. If you fail to maintain the premises in accordance with building codes and other regulations, or if you fail to act when there is damage or injury on the premises, then you could be held liable for damages. Landlord insurance will help cover these costs if they arise.

A property portfolio is a collection of properties owned for investment purposes.

The portfolio can include residential and commercial properties, as well as land, with the aim of providing long-term capital growth.

A property portfolio is typically managed by a professional property manager who will oversee its day-to-day management. Properties in a portfolio are usually located in the same area or region, and are often purchased at similar times. This allows the investor to benefit from economies of scale when purchasing and managing their properties.

In the UK, there are several taxes that landlords need to pay. These include:

Income Tax: Landlords must pay a tax on their rental income from buy-to-let properties. This is charged at a rate of 20% of the gross rental income from your property less any allowable expenses such as mortgage interest and maintenance costs.

Stamp Duty Land Tax (SDLT): If you buy a property for more than £250,000, you will have to pay Stamp Duty Land Tax when you complete on the purchase. You will also have to pay an additional 3% surcharge because the property is not your main residence.

Capital Gains Tax (CGT): If you sell assets and make a profit, this profit is subject to Capital Gains Tax.

Rental yields are a key metric for property investors, as they show the potential returns on investment. Rental yields are calculated by dividing annual rent by the purchase price of the property. Generally, a yield between 5-6% is considered a good rental yield. However, average returns vary from region to region.

The buy-to-let market continues to be a profitable investment for investors in 2023. With interest rates at an all-time low and demand for rental properties high, this is an ideal time for those looking to invest in property that will provide a steady income stream.

If you are considering buying a property for investment purposes, it’s important to do your research before making an offer. You should consider factors such as location and condition of the property before making any commitments.

Access advice and unique property investment opportunities directly from leading developers throughout the UK

Please read

I declare that I am a self-certified sophisticated investor for the purposes of the restriction on promotion of non-mainstream pooled investments. I understand that this means:

I am a self-certified sophisticated investor because at least one of the following applies:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me seek advice from someone who specialises in advising on non-mainstream pooled investments.

Please read

I make this statement so that I can receive promotional communications which are exempt from the restriction on promotion of non-mainstream pooled investments. The exemption relates to certified high net worth investors and I declare that I qualify as such because at least one of the following applies to me:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me to seek advice from an authorised person who specialises in advising on non-mainstream pooled investments.

STAY AHEAD OF THE MARKET

We send limited and targeted emails on new launches and exclusive deals which best fit your areas. We are trusted by over 30,000 active buyers as their source for new stock.

FIRST FOR NEWS AND KNOWLEDGE.

Established since 2005 we are a leading voice of authority and commentary on the UK property market. Our news is trusted by Apple News & Google News.

Speak to our UK property experts today:

Open from 9am-6pm GMT

Open from 9am-6pm HKT