Assured Rent Housing Association Leases

North of England

Assured rent housing association leases. Properties on social housing leases from 5-10 years.

Let us help you secure buy-to-let property in Leeds to ensure unrivaled passive income.

As an award-winning investment consultancy, BuyAssociation is dedicated to providing our community of investors with property-based products sourced directly from leading developers in the UK.

We connect investors and developers at the primary stages of development projects, securing exclusive discounts through our group buying power. Our careful approach to acquiring investment opportunities grants our clients access to high-quality, lucrative developments before anyone else. We work closely with developers both regionally and internationally, and some of the locations we focus on include Manchester, Leeds, Stockport, Salford, Liverpool, Birmingham and Nottingham.

By turning to BuyAssociation, you can expect to benefit from a smooth, streamlined and straightforward investment process. To talk to us about acquiring strong investments, get in touch today.

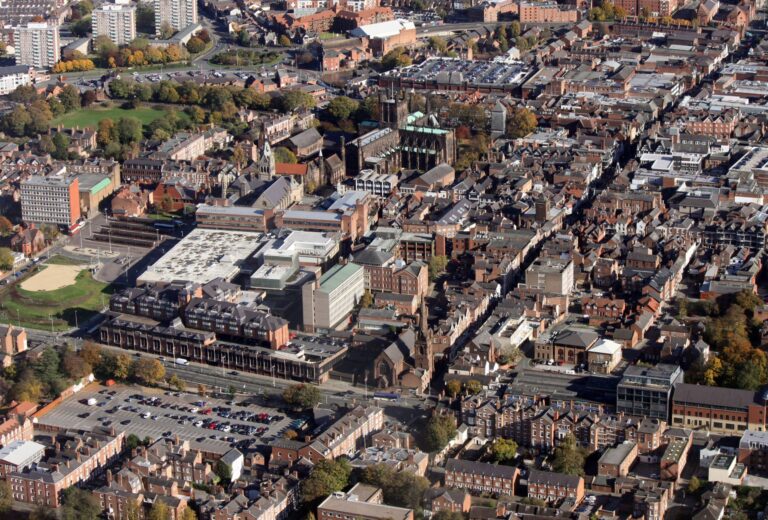

Leeds is a city with a lot to offer. It has a thriving economy and an excellent transport network, as well as being home to some of the best universities in the country. With all these advantages, Leeds property investment can be an exciting opportunity for any buy-to-let investor.

With our extensive knowledge of the local area and the market, we can offer advice on value, location, and other factors that may affect your decision-making process. Whether you are a first-time buyer or an experienced investor, we can help find the perfect property for your needs.

If you’re ready to purchase an investment property in Leeds, browse our investment opportunities below to find out more.

The growth of the Leeds rental market goes hand in hand with the city experiencing a significant rise in housing stock. This is due to city-wide investment plans that all point to a future active economy. Consequently, these plans are increasing awareness about the rental market among residents. The fact that Leeds is a growing area makes it a good place to invest.

In terms of demographics, renting is at record levels for the younger age groups. For this rental market, apartments are among the most viable investment properties. With this, HMO property investment is proving extremely lucrative in and around city centres, and Leeds excels in this asset class due to its high student and young professional population.

The average Yorkshire rental price has reached £655, up 8.5% since 2021, with Leeds itself experiencing a 9.6% boost as young people have returned to the city following the lifting of Covid travel restrictions. According to Zoopla’s quarterly Rental Market Report, a number of factors contributed to this increase. Because of the increasing demand and endless opportunities that this city presents, rental yields produced from buy-to-let property investments in Leeds outperformed those produced by London’s private rental sector in 2020. Landlords can expect to secure a high yield of 8% in some Leeds city centre postcodes, which is double the figure of the UK’s average. As for the rest of the areas outside of the city centre, landlords can achieve around 4.3% in rental yields.

Average rent across the UK is on track to reach almost £1,000pcm, which is £62 more than it was at the start of the pandemic. However, the average rent for residential properties in the city of Leeds sits at around £1,049 as of the start of 2022. Because of this high figure, investors can expect higher rental returns from their Leeds-based buy-to-let investments.

It goes without saying that the entirety of the UK is seeing prolific growth in the housing sector, with the leading cities experiencing rapid increases in house prices, rental costs and investment. Leeds, in particular, is amongst one of the dominant cities whose property market is outperforming many other prime UK cities.

In 2021, the average sale price of a standard property in Leeds rose by around £25,000. In fact, it has been projected that house prices in Yorkshire will increase by 21.6% in the next five years, with the demand for city-centre apartments driving both rental and housing costs up year on year.

Leeds is a top student city in the UK and boasts one of the largest student populations in the country. The city has the highest concentration of higher education institutions outside of London – almost 40,000 Leeds-based students graduate each year. Leeds is home to four prominent universities, including the University of Leeds, Leeds Beckett University, Leeds Trinity University, and Leeds Arts University.

Graduates also require housing; it is not just students. Graduating students at Leeds tend to stay in the city after they graduate, with the retention rate currently sitting at around 30%. As a result, the rental market remains solid outside of the academic year. Graduates tend to fall under the bracket of most desirable tenant types, as young professionals seek high-quality housing at an affordable price. In fact, one in four landlords claim to prefer housing this tenant type due to their long-term commitment to their careers and rental property.

Student investment property covers a large blanket of asset classes, including HMO property and the growing build-to-rent model.

Leeds’ stable employment base and diverse sectors play an integral role in its appeal to investors and young professionals. Currently, there are around 126,000 companies based in the Leeds city region, with this number forecasted to increase in the coming years. Moreover, employment is predicted to rise by an average of 6.5% over the next 10 years. This is an extraordinarily high increase in comparison to most other prime cities in the UK.

Leeds is home to a plethora of sectors, including retail, leisure, construction and manufacturing. The digital industry, in particular, is a fast-emerging sector in the Leeds city region and has so far employed over 100,000 individuals. The opportunities that continue to arise in the digital space suggest that more and more talented people will choose to relocate to Leeds and contribute to the strong demand for housing. The dominating sectors in Leeds, however, are financial and business services, which accounts for 38% of the total output.

Large-scale regeneration work and the rapidly growing economy are what continue to attract such big players to base their headquarters in this area. Some big names include the likes of Asda, Jet2, NHS England and Tetley’s Brewery. It is with thanks to these triumphant businesses that more young people opt to study, work and live in Leeds – such large companies offer unrivalled opportunities that cannot be found elsewhere.

At BuyAssociation, we source investment opportunities by conducting significant research on data and statistics, market forecasts, average property prices, economic growth and tenant demand. By paying attention to exciting locations with endless opportunities in industry and property, we can acquire developments that will maximise property portfolios. It is crucial as a property investor to focus on locations with strong metrics and positive forecasts.

Whether you are a first-time investor or an experienced property buyer, the following primary factors should always be considered when searching for advantageous investment property:

Taking into account the intended value of your property once it comes to reselling is vital for achieving capital appreciation. As part of your location research, take a look into the significantly higher valued homes and where they may be placed across the city. You want to ensure that the price you pay for a property is worth exactly what you pay, factoring in any additional costs such as requirements for renovation, property taxes and maintenance.

City centre living is popularising in many key cities across the country. For this reason, many tenants are willing to pay a high rental cost for the convenience of living in a central area in close proximity to universities, businesses and retail. By researching the average rent charges of different locations of interest, you will be able to accurately estimate the rental costs you should be charging. Similarly, it is essential that the location you pick has constant rental demand in order to avoid void periods and loss of income.

Investing in a prime area predicted for strong future growth is crucial to your decision making. By analysing the forecasts for population and economic growth, you should be able to narrow your search. As an increase in population occurs, the demand for housing correlates, leading to an even larger increase in investment opportunities.

Many of the UK’s biggest cities have transformed into specialised business hubs for a variety of sectors. By looking into the prospects for careers and upcoming jobs in different areas, you should gain an understanding of how likely people are to move to that location. Most of the UK’s thriving cities are also prominent for business, meaning that a rise in population is inevitable where people wish to relocate to advance their careers.

Locating profitable property in Leeds can be difficult, as can securing discounted down payments. Because of this, we encourage both experienced investors and first-time buyers to join forces with BuyAssociation to gain access to the best upcoming opportunities. Not only can our expert team connect you with leading developers and help you to secure lucrative deals, but they can also assist you with every step of the investment process.

We specialise in acquiring buy-to-let apartment blocks, short-term let properties and social housing leases from our partners. Whether you are a first-time buyer or an experienced investor, our expert team can connect you with promising developers to begin or expand your portfolio. By talking to us, we can ensure that we obtain opportunities that maximise your return on investment and complement your property portfolio. Above all, we dedicate ourselves to exceeding your expectations and helping you to achieve your property goals.

To uncover the most promising opportunities in the property market, our team works across Manchester, London, Reading, Liverpool, Leeds, Birmingham and beyond. During the earliest stages of development, we offer early access to all kinds of properties, including exclusive, off-market offerings. Investing in properties at this stage is a great way for our institutional partners and international investors to earn high returns. With decades of combined experience, BuyAssociation is able to offer guidance to investors at every step of the decision-making process.

Find out how we can elevate your portfolio by contacting our specialist team of property consultants today.

Access advice and unique property investment opportunities directly from leading developers throughout the UK

Please read

I declare that I am a self-certified sophisticated investor for the purposes of the restriction on promotion of non-mainstream pooled investments. I understand that this means:

I am a self-certified sophisticated investor because at least one of the following applies:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me seek advice from someone who specialises in advising on non-mainstream pooled investments.

Please read

I make this statement so that I can receive promotional communications which are exempt from the restriction on promotion of non-mainstream pooled investments. The exemption relates to certified high net worth investors and I declare that I qualify as such because at least one of the following applies to me:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me to seek advice from an authorised person who specialises in advising on non-mainstream pooled investments.

STAY AHEAD OF THE MARKET

We send limited and targeted emails on new launches and exclusive deals which best fit your areas. We are trusted by over 30,000 active buyers as their source for new stock.

FIRST FOR NEWS AND KNOWLEDGE.

Established since 2005 we are a leading voice of authority and commentary on the UK property market. Our news is trusted by Apple News & Google News.

Speak to our UK property experts today:

Open from 9am-6pm GMT

Open from 9am-6pm HKT