The North West of England has seen a surge in popularity among property investors in recent years, and new data has revealed it was also the top region for mortgaged homebuyers this year.

Over the course of 2024, several things have shifted within the UK housing market, and the mortgage market in particular. This includes the Bank of England reducing its base rate twice, to its current level of 4.75%, from 5.25% – the first reduction since March 2020.

As mortgage rates have fallen, confidence in the UK property market has resumed to more ‘normal’ levels after a slower 2023. This has meant house prices across all parts of the country have increased, with average prices jumping by 4.8.% in the 12 months to November according to figures from Halifax.

The start of the year was marred by some political uncertainty ahead of the general election, so the market saw a renewed sense of optimism once the decision was made and the Labour party were voted in.

Affordability has also improved this year, according to analysts, when looking at salary growth in relation to inflation and rising prices, partly thanks to falling mortgage rates. The hope is that this will continue over the course of 2025, with more rate cuts to come.

Regionally, the UK property market remains somewhat polarised, with the North West and the North East in particular seeing much faster property price rises, a greater number of transactions, and extremely strong tenant demand and rental yields.

Manchester in the North West also continues to experience the biggest house price rises of any city in England, according to Zoopla, while Liverpool – also in the North West – also appears high on the list for capital growth.

The spread of UK homebuyers

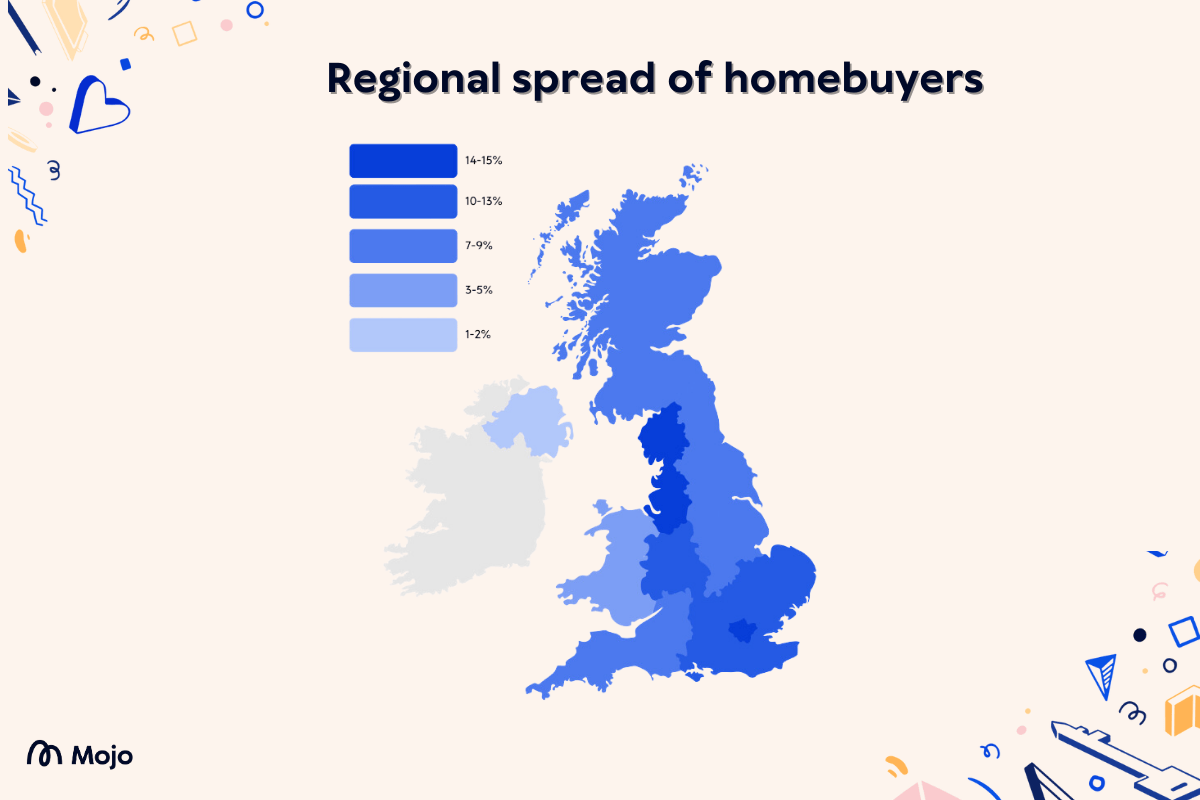

New research from Mojo Mortgages has revealed the regional spread of homebuyers from its borrower figures, where it highlights where its customers have bought property during 2024.

The North West has come out on top with the highest proportion of buyers purchasing property there this year, at 15%. Just behind the North West is Greater London, which remains a popular destination for the homeowners and investors that can afford the higher prices there.

The third highest ranking location for Mojo Mortgages customers was the South East with 12% of the share in 2024, followed by the West Midlands (10%), Scotland (9%), East Midlands (9%), East of England (9%), North East (8%), South West (8%), Wales (5%) and Northern Ireland (1%).

Why the North West?

From a property investment perspective, the North West is much more of an ‘untapped’ market than places like London and other parts of the south.

This means that not only does the region have significantly lower average house prices, but there is also much more forecast growth in the area due to regeneration, transport improvements and improving jobs markets in many of the towns and cities due to companies relocating.

From a homebuyer’s perspective, similar factors are important; an affordable price means getting more space or a better location for your money, while having greater room for growth means you can increase the equity in your home more quickly.

The major cities of Manchester and Liverpool in the North West have already undergone major regeneration, but hundreds of projects are still ongoing and in the pipeline as the populations of both cities are set to climb. This means a huge amount of scope for investors, while buyers will enjoy the benefits of a location on the up.

Other places such as Salford, Preston, Bolton, and Stockport have seen similar trends as their central areas have improved, bringing more people and therefore more demand for property. This demand can be seen among homebuyers and tenants alike.

If you’re interested in investing in property in the North West, or in some of the UK’s other top-performing locations, get in touch with BuyAssociation today and find out more about our current and upcoming opportunities.