While investors and landlords are snapping up properties with top EPC ratings, many are finding it more difficult to sell homes with poorer energy efficiency standards.

There is now more reason than ever for landlords to consider investing in newer properties with the highest energy performance certificate (EPC) ratings, as greater awareness around the issue of energy efficiency has led to many landlords finding it harder to sell homes with low ratings.

According to the latest findings from Foundation Home Loans, using a study from BVA BDRC looking at landlord trends in Q2 2023, almost three quarters (71%) of landlords are “unlikely” to invest in a property that is rated below C. EPC ratings range from A-G, and rental properties must be rated E or higher currently.

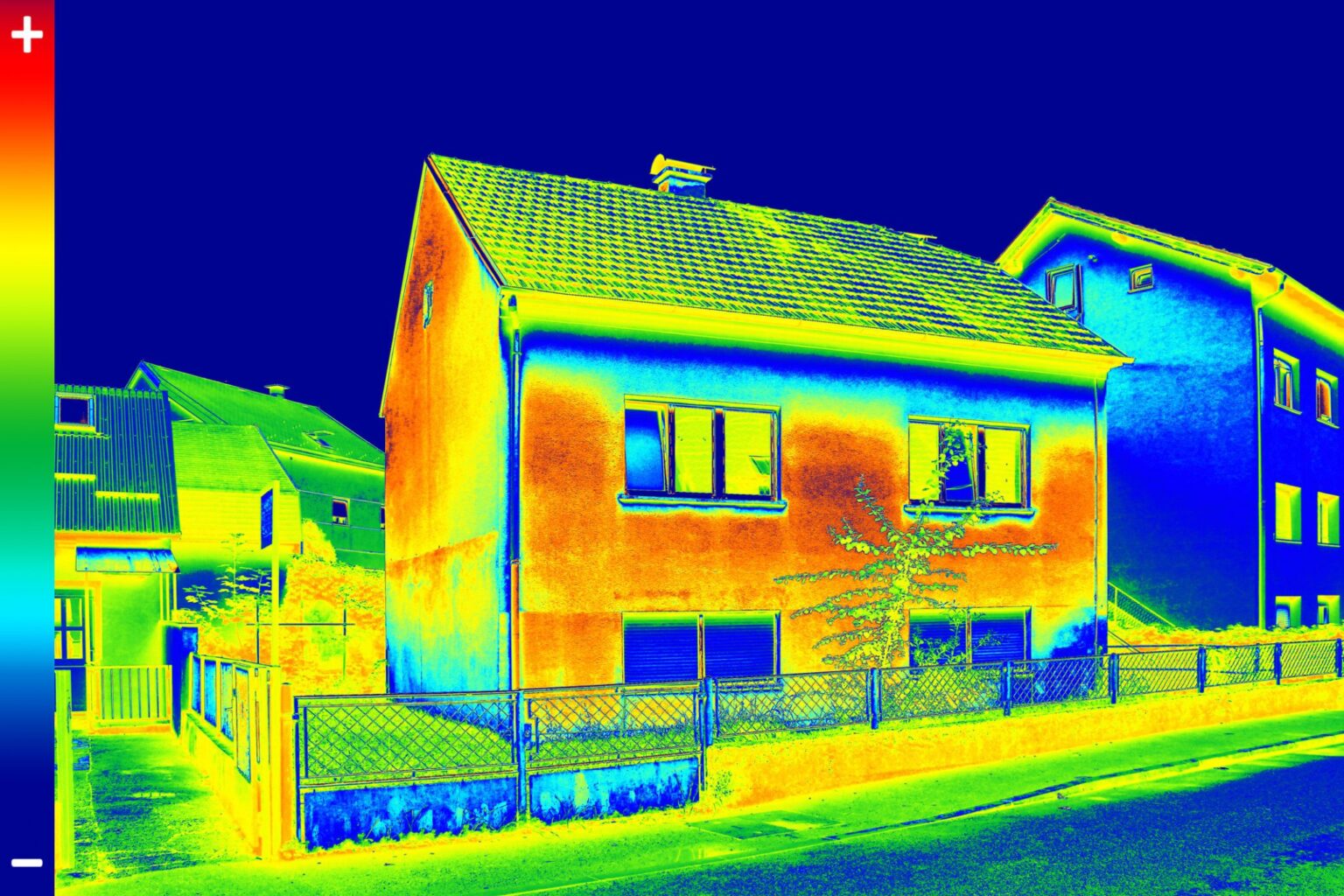

This is likely to be down to a combination of factors: there is currently a proposal making its way through Parliament that is likely to see the minimum energy efficiency standard in the PRS increased to C; and tenants are more drawn to energy efficient homes as they can offer significantly cheaper energy bills.

While many people were only vaguely aware of the meaning of an EPC rating a few years ago, now they are an increasingly crucial factor in many investors’ decision-making when it comes to a property purchase. As a result, those trying to offload their lower-rated properties are now seeing less interest from other landlords.

Top EPC ratings becoming essential

In the survey, only 18% of landlord respondents said that having a top EPC rating would make no difference to their next property investment. Meanwhile, 74% of those who owned between six and 19 properties said they were less likely to buy a lower-rated property, and 78% of those with 20 or more properties said the same.

While the energy efficiency requirements of rental properties is certainly influencing a growing number of investors in their future plans, awareness around how minimum standards are expected to change is also growing. Only 4% of respondents had no knowledge at all of future legislation changes.

By contrast, 71% claimed to be fully aware and understood the details, while 24% said they were aware but did not fully understand the details. This is understandable, though, as the government has yet to fully confirm that the current proposals working their way through Parliament will go ahead as planned.

A quarter of landlords who currently own properties rated D or lower do not plan to carry out any works, and instead intend to sell the property or not re-let it. Retrofitting and upgrading a property to achieve a top EPC rating can be costly, so is not always worth it for some investors.

Upgrade or buy new?

According to the survey, landlords believe that it could cost around £10,000 per property, on average, in order to ensure it achieves the required C rating if future legislation comes to fruition. A third of landlords said they would increase the rent to fund this, while 57% may use their savings.

Of course, a top EPC-rated property is likely to attract tenants who will pay more rent in order to live in a higher quality property with lower bills. Meanwhile, some experts have pointed out that we could start seeing a ‘brown discount’, where lower-rated properties become even cheaper as they are less desirable.

A growing number of investors are now turning to new-builds as a more future-proof investment option – particularly if purchased off-plan in order to obtain a brand-new property at a lower price. New-builds tend to achieve top EPC ratings, meaning lower bills for whoever lives in them.

Green mortgages incentivising buyers

Grant Hendry, director of sales at Foundation Home Loans, pointed out that the sector is still waiting for more certainty over when minimum EPC levels could be raised for rental homes.

He added: “It’s clear from this research that landlords are aware of what is likely to be coming, and are thinking seriously about their existing portfolios, how they might fund improvements, and what their plans might be when this is introduced.

“With landlords anticipating a cost of over £10k per property in order to improve its EPC level to C, it is perhaps not surprising they are disinclined to buy properties already below this.

“In effect, they are future-proofing their portfolios by opting only to buy C and above properties now, while they will presumably focus on those properties within their portfolio which are not currently at this level.”

He also pointed out that more lenders are now offering green mortgages on properties with top EPC ratings, and this is incentivising more buyers to invest in new-builds or more energy efficient homes in order to save money on their borrowing.

“Overall, it seems clear this will remain a major focus within the PRS for years to come, and from an advisory point of view, it is clearly worthwhile having these conversations with landlords immediately, particularly for those at the point of refinance, as they might want to take advantage of this opportunity in order to secure the funding they require for the works.”

BuyAssociation specialises in introducing investors to off-plan and new-build property investment opportunities, often with top EPC ratings than older rental homes. Browse some of our current projects, or get in touch for more information.