Specialist mortgage lender LendInvest has put together a new index of the country’s best and worst areas for buy-to-let investment. Here are the UK’s biggest buy-to-let yays and nays.

The report named Luton as the best place for buy-to-let investments in the UK as the Bedfordshire area has experienced a 7.37% increase in rental price growth.

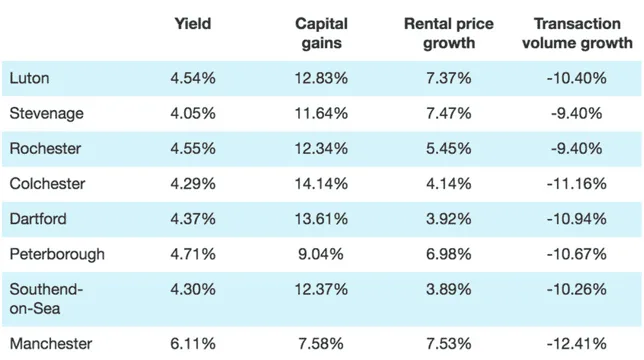

The research looked at each postcode area around England and Wales and focused on a combination of four critical metrics: transaction volumes, rental price growth, rental yield and capital value growth.

Some of the study’s biggest surprises included former table-leader Romford dropping by 9 spots after a 2.13% decrease in capital gains and falling rental yields and Manchester entering the top 10 after an impressive rental price growth increase of 7.53%.

Co-founder and CEO of LendInvest, Christian Faes, commented the results: “Against a backdrop of all the political upheaval the country has endured in the last quarter, it isn’t surprising to see some significant changes in the performance of postcodes against one another. We’ve seen last quarter’s top performing postcode, Romford, fall nine places; while Manchester – unofficial home of the Northern Powerhouse – ascended to the Top 10 for the first time.”

“These shifts, however, are more isolated than systemic and the fact that there has not been a greater shake-up in the top 10 buy-to-let postcodes signals the durability and resilience of the UK property market.”