The Commonwealth Games has held the city of Birmingham in the headlines in recent weeks, but behind the scenes property investors are increasingly gravitating towards the Midlands hotspot.

Just days after the closing ceremony heralded the end of a star-studded Commonwealth Games, where Australia won the most medals but was closely followed by England, there is still a buzz around the host city of Birmingham. The build-up to the Games was long, and the after-effects will be equally long-standing.

Birmingham property investment has been attracting interest from far and wide for a number of years now, with many investors reaping great rewards from strong rental yields, reliable capital appreciation and a swathe of regeneration bringing more people to the city.

Below are five reasons why Birmingham remains a favourite among investors.

1. Commonwealth Games

It is no secret that millions of pounds of public money was invested in Birmingham ahead of the Games. This paid for infrastructure and transport improvements, the transformation of Alexander stadium, and a large number of new developments to allow the city to host the event.

With any leftover money from the Commonwealth Games budget, the council has put forward four legacy proposals for Birmingham. This includes investing in grassroots and culture, a project focusing on particular families, a new Museum of Science and Industry, and a bid to host the European Athletics Championships 2026.

2. HS2 – Solihull

According to Andy Street, Mayor of the West Midlands, HS2’s arrival at Solihull is going to make the area the “best investment opportunity in the UK”. He cites 140 hectares of regeneration, 27,000 jobs, 3,000 homes and 6 million sq ft of commercial space.

“Arden Cross could be quite incredible, and it’s fantastic to see the plans develop after we put £45m on the table,” he added on Twitter. Many property investors with long-term aspirations are investing in the area ready for HS2’s arrival, which is forecast to spark a major influx in interest.

Property expert Jonathan Rolande said: “The increase in northern house prices is going to create a decade of opportunity and investors will be looking for the pot of gold at the end of the HS2 line.”

3. BBC in Birmingham

One surefire way of attracting investors, owner-occupiers and renters to an area is jobs. This is why the BBC’s arrival in Digbeth is so hotly anticipated by many, as it will not only become a major employer itself, but is likely to be the catalyst for more big companies moving to the up-and-coming area.

Digbeth’s new creative quarter will house the BBC’s new broadcast centre, with the team currently based at The Mailbox. The relocation is expected to take place from 2026, and will see the relocation of programmes like MasterChef and Newsbeat.

4. House prices

House prices in Birmingham could soar by up to 15%, according to estate agency Barrows and Forrester. This is based on similar historic house price rises off the back of past Commonwealth Games, all of which saw house prices climbing by an average 14.9% in the aftermath.

Whether or not these predictions materialise, one major draw to Birmingham is its relative affordability compared with London and much of the south east of the country. Savills says that house prices in the Midlands city are almost a third of those in the capital, meaning more options for investors.

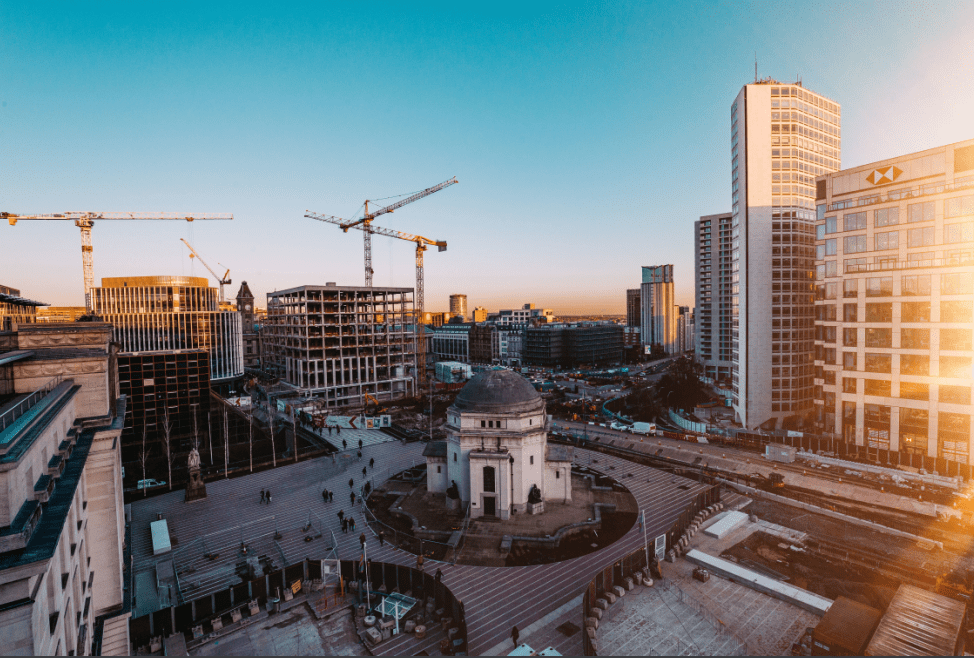

5. Regeneration

Many of the points mentioned above have caused a snowball effect of regeneration in Birmingham, creating a more desirable place to live and work, which leads to a strong housing and rental market. Major firms like Goldman Sachs and HSBC have already relocated there, for example.

There are some major redevelopment schemes in the pipeline, too, like a £1.9bn regeneration of the city centre Smithfield site by Lendlease, which will bring new homes and a festival square complete with cafes and a marketplace.

The Birmingham Big City plan has also targeted new developments as well as major infrastructure improvements, which greatly add to the appeal of the city as a property investment target.

BuyAssociation has a range of property investment opportunities available in and around Birmingham. Get in touch for more information.