As full lockdowns become a distant memory in the UK, it seems some property decisions are still being influenced by the pandemic. Could this continue to impact the London rental market?

The pandemic undoubtedly had a big effect on the UK housing market, from buying and selling patterns to rental decisions. For many, life will never return to ‘normal’, despite the fact that lockdowns are a thing of the past and people are returning to the office in their droves.

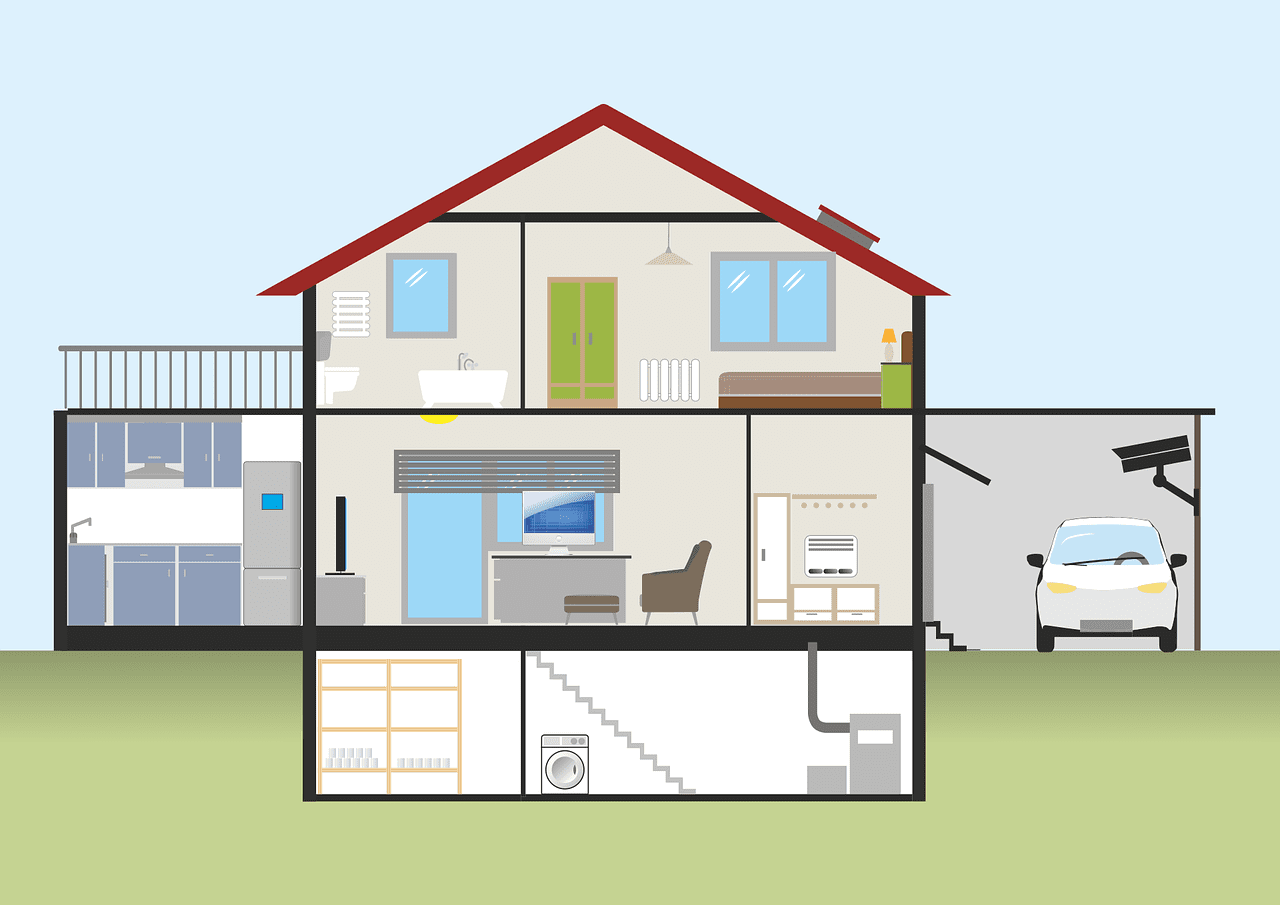

The so-called race for space that punctuated people’s home moving decisions at the height of the crisis certainly seems to have slowed down as many are reassessing what they now need and where they want to live.

However, according to a poll by lender TAB, the idea of tenants seeking larger homes now is certainly not over, and it seems the London rental market could feel this the most keenly.

The report found that almost three quarters (69%) of brokers who are active in specialist lending believe the race for space is not over based on what they are seeing in the market. This compares to less than a quarter (23%) who believe that the race for space is ‘definitely’ or ‘probably’ over.

London rental market difficulties

Duncan Kreeger, founder and CEO of TAB, points out that, in the last quarter of 2020, flats in London were spending 20% longer on the market before being rented out compared with pre-pandemic. City centre residential rents were also on a downward spiral, fuelled by tenants moving away.

On the other hand, houses in the London rental sector were being let out 10% faster.

He adds: “Then, in the first three months of 2021, home movers flush with housing equity left first-time buyers trailing as the drivers of the UK housing market, as the race for space led to a switch in the long-term balance of demand.

“I didn’t expect that to last until now. A year down the line and brokers are telling us this trend is still dominating the market. The move to home working during the pandemic loosened ties to the office and emerging hybrid working conditions are making distant suburban and more rural living more possible.

“Buyers with savings are targeting bigger properties with more outdoor space.”

Delving deeper into preferences

TAB also pointed to research from recruiter Randstad UK, which was published in early March. It asked workers what they missed most about office life when working from home, and the most popular answer, from 52% of people, was “Nothing”.

A quarter of people said they missed “drinks with mates and flirting with colleagues”, while 15% said they missed the commute and time alone. A further 8% said they missed “being away from my spouse or family”.

The survey also showed that even now, offices are relatively under-occupied, adding further impetus to the argument that the race for space could be set to continue. In February, offices were on average less than 25% full, compared with 55-60% full pre-pandemic.

While hybrid working and home-working have certainly affected people’s buying and renting behaviours, it is unsurprising that the London rental market felt this the most keenly. You get much less space for your money in the capital, and it is relatively easy to commute in from elsewhere.

City centre living isn’t over

London rental prices are high, and the cost of living in general is at a premium, and these have been factors pushing more tenants to consider other parts of the country – including cities.

February’s UK Rental Market Report from Zoopla noted heightened demand in UK cities from renters, particularly over the past six months.

The pandemic arguably created a dip in appetite as amenities in cities temporarily closed down, and some tenants chose to move further afield, but life is now beginning to return to normal for many.

Offices have reopened, students are returning and international demand is climbing once again, says Zoopla, which is all creating a buzz around UK cities. Whether this will begin to reflect more in the London rental scene will become apparent in the coming months.

Whether you’re looking to invest in a city centre apartment or an ideally located property in the commuter belt, BuyAssociation can find the right property investment opportunity for you. Get in touch to find out more.