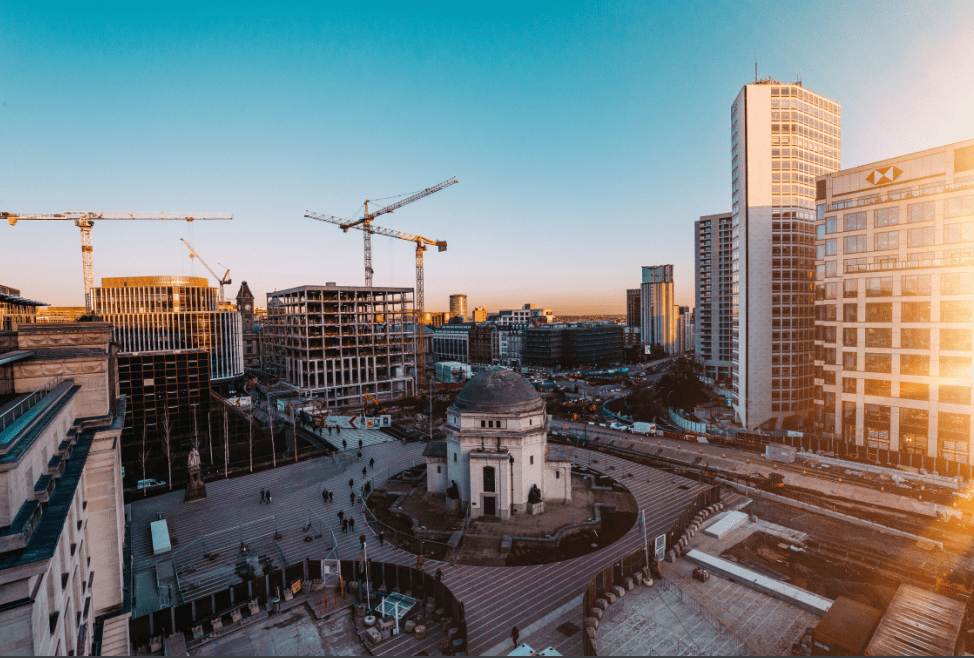

Fountain Court

How To Find Fountain Court, Birmingham

70 period-style apartments in regal law chambers in the heart of Birmingham's B4 Snow Hill Business District and conservation area.

Price

FROM £255,000

Unlock top-tier buy-to-let property investment opportunities with BuyAssociation ahead of the market, with discounted access to high-yielding opportunities in the best UK locations.

Our award-winning team of experienced property investment consultants will work with you to find the best buy-to-let investment opportunities direct from the developer, and tailored to your goals. We offer early access to a diverse range of high-yielding opportunities, simplifying the investment process to help you build a lucrative property portfolio.

From negotiating deals to navigating legal and financial requirements, our team of experts can guide you through your entire investment journey. Contact our team to discuss your buy-to-let property investment goals, access off-market opportunities, and join our investor community.

A buy-to-let property is a rental home that generates an income through both rental payments from tenants and through capital appreciation over time. Buy-to-lets can offer a highly lucrative, stable investment option thanks to the UK’s resilient housing market, supported by strong rental demand coupled with long-term value growth. From highly sought after city centre apartments to characterful rental homes in up-and-coming commuter towns, or family housing close to schools and amenities, buy-to-let property comes in many forms to suit today’s wide range of tenant types.

Buy-to-let properties provide a steady and predictable stream of rental income, which can be enhanced by choosing an area that offers the strongest yields for landlords.

UK property values tend to appreciate over time, allowing investors to make an attractive profit when it comes time to sell, whether simply to unlock some capital or in order to reinvest.

The UK housing market tends to experience fewer major fluctuations in value compared with other investment options, such as stocks and shares, leading it to be viewed as a ‘safe’ option among investors.

Investing in buy-to-let properties allows for diversification across different asset classes, reducing the impact of a downturn in any single market.

The private rented sector in the UK continually experiences extremely high tenant demand, that is generally not being met with supply levels, leading to high occupancy rates in buy-to-let.

Buy-to-let property offers strategies like family homes, city centre flats and HMOs, enabling buyers to align their investments with their goals and resources.

Buy-to-let investment can demand significant upfront costs, including a deposit, stamp duty, legal fees, and sometimes renovations. You should only invest in property if you are in a position to cover these costs. BuyAssociation often recommends £60,000 as a strong baseline for UK property investment.

Landlords face recurring costs like mortgage payments, maintenance, insurance, and letting agent fees which are deducted from the monthly rental income.

Although the sector is one of the more stable asset classes available, it is important to consider fluctuations in property values, rental demand and interest rates, as these can impact your overall returns.

Staying up-to-date with any policy shifts or tax adjustments is a crucial part of investing in buy-to-let property. Keep an eye on our news pages for all the latest in the UK housing market.

Managing a rental property requires time for tenant sourcing, maintenance, and legal compliance. A property management service can support with this, offering hands-free investment.

Periods without tenants can cause income gaps, highlighting the importance of choosing high-demand locations. You could also consider an HMO investment which can avoid the risk of void periods.

Buy-to-let landlords must meet UK laws to ensure compliance and maintain strong landlord-tenant relationships. Key responsibilities include:

For successful buy-to-let property investment, landlords must be prepared to meet these requirements to avoid penalties.

Array

(

[ID] => 4578

[id] => 4578

[title] => 20162017Tax-644x360.jpg

[filename] => 20162017Tax-644x360-1.jpg

[filesize] => 41825

[url] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1.jpg

[link] => https://www.buyassociationgroup.com/en-us/20162017tax-644x360-jpg/

[alt] => Tax

[author] => 1069

[description] =>

[caption] =>

[name] => 20162017tax-644x360-jpg

[status] => inherit

[uploaded_to] => 0

[date] => 2017-08-14 14:57:20

[modified] => 2017-08-14 14:57:20

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-us/wp-includes/images/media/default.png

[width] => 644

[height] => 360

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1-300x168.jpg

[medium-width] => 300

[medium-height] => 168

[medium_large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1.jpg

[medium_large-width] => 644

[medium_large-height] => 360

[large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1.jpg

[large-width] => 644

[large-height] => 360

[1536x1536] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1.jpg

[1536x1536-width] => 644

[1536x1536-height] => 360

[2048x2048] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1.jpg

[2048x2048-width] => 644

[2048x2048-height] => 360

[post-thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 70

[landscape_600x400] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1-600x360.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 360

[landscape_500x300] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2016/12/20162017Tax-644x360-1-644x350.jpg

[landscape_750x350-width] => 644

[landscape_750x350-height] => 350

)

)

A number of UK taxes apply to buy-to-let property investment, which landlords and investors should take into consideration for effective financial planning. Some taxes vary depending on the specific investment type, with certain reliefs available, which you can learn more about on the government’s website or through a tax specialist.

All residential property purchases above £125,000 in the UK are subject to stamp duty land tax (SDLT), with the amount owed depending on the value of the property. When investing in an additional property, whether as a buy-to-let or a second home, a 5% stamp duty surcharge applies.

Use our stamp duty calculator to determine how much stamp duty you might have to pay on your buy-to-let investment.

Landlords must pay income tax on their rental income after deducting allowable expenses such as letting agent fees and maintenance. Again, the government’s website can offer more guidance on how to calculate your tax, as well as information on tax brackets and rates. How much you can claim might also depend on the property type as well as whether you own the property as an individual or through a limited company.

When it comes time to sell your buy-to-let investment property, it will likely be subject to capital gains tax, which is calculated on the difference between the original purchase price and what you achieve upon sale. You will benefit from a tax-free allowance (£3,000 for the 2025/2026 tax year).

A growing number of landlords are choosing to buy and operate their buy-to-let investments through a limited company, as this can provide tax benefits under certain circumstances. You are advised to speak to an expert if you are considering setting up a limited company for buy-to-let property, to ensure it is the best option for you.

The best locations for buy-to-let property investment can change over time, so keeping up to date with the latest trends and research is important to achieve maximum long-term returns. Below are some of the current UK buy-to-let property hotspots.

Array

(

[ID] => 6092012

[id] => 6092012

[title] => Aerial view of Deansgate, Manchester skyline, England, UK

[filename] => New-Manchester-skyline.jpg

[filesize] => 2238816

[url] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline.jpg

[link] => https://www.buyassociationgroup.com/en-us/home-2-2-2/aerial-view-of-deansgate-manchester-skyline-england-uk/

[alt] => New manchester skyline

[author] => 1069

[description] =>

[caption] => Wide angle aerial view of the skyline of Manchester, England, UK

[name] => aerial-view-of-deansgate-manchester-skyline-england-uk

[status] => inherit

[uploaded_to] => 6089994

[date] => 2023-01-05 20:21:43

[modified] => 2023-02-14 13:19:34

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-us/wp-includes/images/media/default.png

[width] => 2121

[height] => 1414

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-300x200.jpg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-768x512.jpg

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-1024x683.jpg

[large-width] => 1024

[large-height] => 683

[1536x1536] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-1536x1024.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1024

[2048x2048] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-2048x1365.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1365

[post-thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-125x125.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 125

[landscape_600x400] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/12/New-Manchester-skyline-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Array

(

[ID] => 6090633

[id] => 6090633

[title] => liverpool-tower-768x441

[filename] => liverpool-tower-768x441-1.jpeg

[filesize] => 97722

[url] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1.jpeg

[link] => https://www.buyassociationgroup.com/en-us/investments/liverpool-tower-768x441/

[alt] =>

[author] => 4195

[description] =>

[caption] =>

[name] => liverpool-tower-768x441

[status] => inherit

[uploaded_to] => 6

[date] => 2022-11-18 12:07:11

[modified] => 2022-11-18 12:07:11

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-us/wp-includes/images/media/default.png

[width] => 768

[height] => 441

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1-150x150.jpeg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1-300x172.jpeg

[medium-width] => 300

[medium-height] => 172

[medium_large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1.jpeg

[medium_large-width] => 768

[medium_large-height] => 441

[large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1.jpeg

[large-width] => 768

[large-height] => 441

[1536x1536] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1.jpeg

[1536x1536-width] => 768

[1536x1536-height] => 441

[2048x2048] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1.jpeg

[2048x2048-width] => 768

[2048x2048-height] => 441

[post-thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1-125x125.jpeg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 125

[landscape_600x400] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1-600x400.jpeg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1-500x300.jpeg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2022/11/liverpool-tower-768x441-1-750x350.jpeg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Array

(

[ID] => 6036769

[id] => 6036769

[title] => Birmingham_Centenary_Square

[filename] => Birmingham_Centenary_Square.png

[filesize] => 290944

[url] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square.png

[link] => https://www.buyassociationgroup.com/en-us/birmingham_centenary_square/

[alt] => Birmingham property

[author] => 1

[description] =>

[caption] =>

[name] => birmingham_centenary_square

[status] => inherit

[uploaded_to] => 0

[date] => 2021-10-24 12:39:55

[modified] => 2021-10-24 12:39:55

[menu_order] => 0

[mime_type] => image/png

[type] => image

[subtype] => png

[icon] => https://www.buyassociationgroup.com/en-us/wp-includes/images/media/default.png

[width] => 974

[height] => 658

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square-150x150.png

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square-300x203.png

[medium-width] => 300

[medium-height] => 203

[medium_large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square-768x519.png

[medium_large-width] => 768

[medium_large-height] => 519

[large] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square.png

[large-width] => 974

[large-height] => 658

[1536x1536] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square.png

[1536x1536-width] => 974

[1536x1536-height] => 658

[2048x2048] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square.png

[2048x2048-width] => 974

[2048x2048-height] => 658

[post-thumbnail] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square.png

[post-thumbnail-width] => 125

[post-thumbnail-height] => 84

[landscape_600x400] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square-600x400.png

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square-500x300.png

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-us/wp-content/uploads/sites/8/2021/10/Birmingham_Centenary_Square-750x350.png

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

BuyAssociation investors can gain exclusive access to fantastic discounts on the UK’s most exciting developments. When it comes to sourcing the right buy-to-let property investment opportunities for our valued clients, we take a variety of important elements into consideration before distributing them.

Our award-winning, qualified and experienced team understands what makes a truly valuable investment. We use this our expertise to help both local and international investors secure high-performing buy-to-let properties.

With knowledgeable consultants and trusted relationships with leading developers, we help both UK and international investors secure profitable properties across the UK. Our portfolio includes off-plan, hands-off, and fully managed options across buy-to-let, HMO, social housing, and holiday lets, all backed by positive testimonials.

To find out more or to benefit from our exclusive investor community perks, contact us today on 0333 123 0320 or send us a message.

STAY AHEAD OF THE MARKET

We send limited and targeted emails on new launches and exclusive deals which best fit your areas. We are trusted by over 30,000 active buyers as their source for new stock.

Want to know more? See our frequently asked questions below, or get in touch with us today for a free chat with no obligation.

A buy-to-let is a property that you purchase with the sole purpose of turning it into a rental property. It can be a house, a flat or even a business premises.

When you buy a property to rent out, you are considered a landlord and you have certain legal obligations towards your tenants. You will need to take out insurance to cover any damage or loss that might occur while they live in your property.

You will be responsible for arranging repairs and maintenance, collecting rent from tenants, and managing any disputes that might arise between yourself and your tenants.

A buy-to-let mortgage is a loan that is secured against a property that is rented out to tenants.

Buy-to-let mortgages are most commonly used by landlords who are looking to invest in property for long-term rental profits. While buying with cash can be a popular option for those who have the assets, buying with a mortgage can help investors to spread the risk by investing in multiple assets.

Lenders might require a higher deposit for a buy-to-let, with the amount you can borrow often based on your potential rental income. Interest-only mortgages are popular among landlords, meaning you only pay off the mortgage each month and repay the full outstanding balance at the end of the term.

The law requires landlords to carry landlord insurance in order to protect themselves and their tenants. This protection covers damage you or your tenants might cause to the property, as well as any injuries sustained by visitors to your property.

Landlord insurance is also a great way to protect yourself from lawsuits brought by tenants for negligence on your part. If you fail to maintain the premises in accordance with building codes and other regulations, or if you fail to act when there is damage or injury on the premises, then you could be held liable for damages. Landlord insurance will help cover these costs if they arise.

A property portfolio is a collection of properties owned for investment purposes.

The portfolio can include residential and commercial properties, as well as land, with the aim of providing long-term capital growth.

A property portfolio is typically managed by a professional property manager who will oversee its day-to-day management. Properties in a portfolio are often (but not always) located in the same area or region. However, diversifying the locations you invest in can also be a successful strategy to maximise potential returns.

In the UK, there are several taxes that landlords need to pay which you can learn more about here. These include:

Income tax: Landlords must pay a tax on their rental income from buy-to-let properties. This is charged at a rate of 20% of the gross rental income from your property less any allowable expenses.

Stamp duty land tax (SDLT): If you buy a property for more than £125,000 (as of April 2025), you will have to pay Stamp Duty Land Tax when you complete on the purchase. You will also have to pay an additional 5% surcharge if the property is not your main residence.

Capital gains tax (CGT): If you sell assets and make a profit, this tax is likely to apply.

Rental yields are a key metric for property investors, as they show the potential returns on investment. Rental yields are calculated by dividing annual rent by the purchase price of the property. Generally, a yield between 5-6% is considered a good rental yield. However, average returns vary from region to region, with the North of England generally outperforming the South.

The buy-to-let market continues to be a profitable investment for many investors. The ongoing imbalance between supply and demand continues to support rental prices and ensure high occupancy rates – particularly when investors target locations with high tenant numbers. House prices in the UK are historically extremely resilient, meaning long-term capital appreciation can be factored into your property investment.

If you are considering buying a property for investment purposes, it’s important to do your research before making an offer. You should consider factors such as location, price and condition of the property before making any commitments.

Access advice and unique property investment opportunities directly from leading developers throughout the UK

Please read

I declare that I am a self-certified sophisticated investor for the purposes of the restriction on promotion of non-mainstream pooled investments. I understand that this means:

I am a self-certified sophisticated investor because at least one of the following applies:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me seek advice from someone who specialises in advising on non-mainstream pooled investments.

Please read

I make this statement so that I can receive promotional communications which are exempt from the restriction on promotion of non-mainstream pooled investments. The exemption relates to certified high net worth investors and I declare that I qualify as such because at least one of the following applies to me:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me to seek advice from an authorised person who specialises in advising on non-mainstream pooled investments.

STAY AHEAD OF THE MARKET

We send limited and targeted emails on new launches and exclusive deals which best fit your areas. We are trusted by over 30,000 active buyers as their source for new stock.

FIRST FOR NEWS AND KNOWLEDGE.

Established since 2005 we are a leading voice of authority and commentary on the UK property market. Our news is trusted by Apple News & Google News.

Speak to our UK property experts today:

Open from 9am-6pm GMT

Open from 9am-6pm HKT