Assured Rent Housing Association Leases

North of England

Invest in property on a social housing lease from 5-10 years with a secure, assured income from day one

Leeds’ growing economy and strong rental demand make it a top UK destination for property investment.

Choosing to invest with BuyAssociation grants you exclusive access to opportunities that can maximise your passive income stream. We connect investors to with trusted developers early in the development process, offering discounts and first-mover advantages on high-demand properties.

Leeds, one of our key cities, provides exceptional opportunities from city-centre flats to new-build homes appealing to a range of tenants.

We offer a transparent property investment process. Contact us today to explore buy-to-let property investment opportunities in Leeds.

Array

(

[ID] => 21817

[id] => 21817

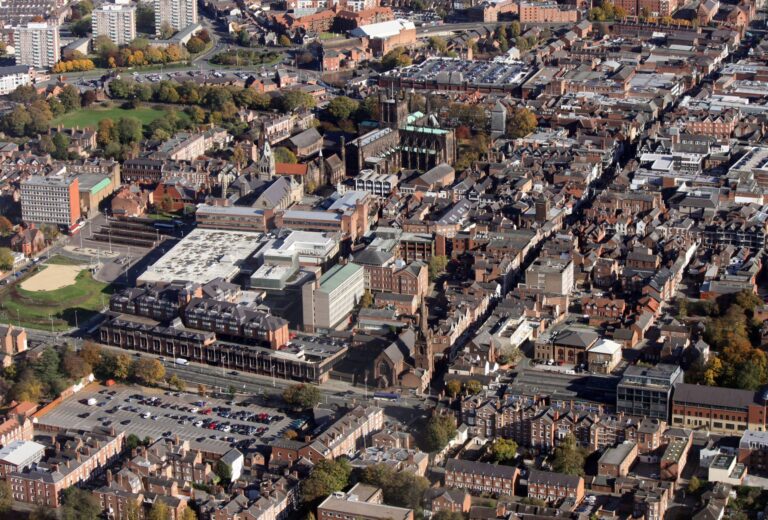

[title] => Leeds Town Hall, Leeds West Yorkshire,England

[filename] => Leeds_town_hall_011118.jpg

[filesize] => 621180

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118.jpg

[link] => https://www.buyassociationgroup.com/en-gb/investments/leeds-town-hall-leeds-west-yorkshireengland/

[alt] => Leeds city centre and the town hall from the Headrow

[author] => 3875

[description] =>

[caption] => Leeds Town Hall was built on Park Lane (now The Headrow), Leeds, West Yorkshire, England.

[name] => leeds-town-hall-leeds-west-yorkshireengland

[status] => inherit

[uploaded_to] => 6

[date] => 2018-11-01 09:03:34

[modified] => 2022-11-28 10:57:53

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2048

[height] => 1368

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-300x200.jpg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-768x513.jpg

[medium_large-width] => 768

[medium_large-height] => 513

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-1024x684.jpg

[large-width] => 1024

[large-height] => 684

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-1536x1026.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1026

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1368

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 83

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/11/Leeds_town_hall_011118-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Array

(

[ID] => 6037835

[id] => 6037835

[title] => Leeds canal

[filename] => Leeds-canal-scaled-1.jpg

[filesize] => 488565

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1.jpg

[link] => https://www.buyassociationgroup.com/en-gb/leeds-canal/

[alt] => Photo of the Leeds canal with impressive modern residential developments

[author] => 1

[description] =>

[caption] =>

[name] => leeds-canal

[status] => inherit

[uploaded_to] => 0

[date] => 2021-11-28 11:37:03

[modified] => 2023-11-30 15:13:04

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2048

[height] => 1365

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-300x200.jpg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-768x512.jpg

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-1024x683.jpg

[large-width] => 1024

[large-height] => 683

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-1536x1024.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1024

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1365

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 83

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-canal-scaled-1-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Array

(

[ID] => 6037830

[id] => 6037830

[title] => Leeds city centre

[filename] => Leeds-city-centre-scaled-1.jpg

[filesize] => 432762

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1.jpg

[link] => https://www.buyassociationgroup.com/en-gb/leeds-city-centre/

[alt] => An aerial view of Leeds city centre, showing several impressive property developments

[author] => 1

[description] =>

[caption] =>

[name] => leeds-city-centre

[status] => inherit

[uploaded_to] => 0

[date] => 2021-11-28 10:51:11

[modified] => 2023-11-30 15:14:00

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2048

[height] => 1534

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-300x225.jpg

[medium-width] => 300

[medium-height] => 225

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-768x575.jpg

[medium_large-width] => 768

[medium_large-height] => 575

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-1024x767.jpg

[large-width] => 1024

[large-height] => 767

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-1536x1151.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1151

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1534

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 94

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/Leeds-city-centre-scaled-1-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Leeds has a diverse property market that offers a good range of opportunities to suit any investor’s needs.

Array

(

[ID] => 6041783

[id] => 6041783

[title] => Leeds apartments

[filename] => shutterstock_232806400-1-scaled-1.jpg

[filesize] => 322408

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1.jpg

[link] => https://www.buyassociationgroup.com/en-gb/investments/shutterstock_232806400-1/

[alt] => A view of Leeds apartment blocks at sunset

[author] => 1096

[description] =>

[caption] =>

[name] => shutterstock_232806400-1

[status] => inherit

[uploaded_to] => 6

[date] => 2022-03-25 10:57:23

[modified] => 2023-11-30 17:04:25

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2048

[height] => 1356

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-300x199.jpg

[medium-width] => 300

[medium-height] => 199

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-768x509.jpg

[medium_large-width] => 768

[medium_large-height] => 509

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-1024x678.jpg

[large-width] => 1024

[large-height] => 678

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-1536x1017.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1017

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1356

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 83

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/03/shutterstock_232806400-1-scaled-1-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

At BuyAssociation, we source investment opportunities by conducting significant research on house price and rental data, market forecasts, economic growth and more. By focusing on locations with excellent opportunities in industry and property, we can acquire developments that will maximise property portfolios.

Whether you are a first-time investor or an experienced property buyer, the following primary factors should always be considered when searching for a strong investment property:

As part of your location research, take a look at how property prices vary across the city, and where they have increased the most in recent years. You want to ensure that your property investment is secured at the right price, factoring in any additional costs such as requirements for renovation, property taxes and maintenance.

City centre living is becoming increasingly popular across the UK. Many tenants are willing to pay a higher price for the convenience of living in a central area close to universities, businesses, leisure and retail. By researching average rental prices in your locations of interest, you will be able to accurately estimate your potential yields. Similarly, it is essential that the location you pick has constant rental demand in order to avoid void periods and loss of income.

Investing in a prime area predicted for strong future growth is one of the strongest strategies employed by successful investors. By analysing the forecasts for population and economic growth, you should be able to narrow your search. As an increase in population occurs, the demand for housing correlates, leading to an even larger increase in opportunities and the potential for capital appreciation.

Many of the UK’s biggest cities have transformed into specialised business hubs for a variety of sectors. By looking into the prospects for careers and upcoming jobs in different areas, you should gain an understanding of how likely people are to move to that location. Most of the UK’s thriving cities are also prominent for business, meaning that a rise in population is inevitable where people wish to relocate to advance their careers.

Our property investment specialists can help investors access developments in the UK’s most desirable locations, offering helpful and honest advice throughout the process. Whatever your preferences and investment goals, our forward-thinking team can help you find the best investment opportunities for you, with a track record in staying ahead of the market thanks to our partnerships with the UK’s most reputable developers.

Our streamlined process ensures a hassle-free experience for our investors. We understand that everyone’s investment journey is different, which is why we do things differently at BuyAssociation.

If you’re an investor looking to build your portfolio and want to benefit from our bespoke services, free of charge, contact us today.

Access advice and unique property investment opportunities directly from leading developers throughout the UK

Please read

I declare that I am a self-certified sophisticated investor for the purposes of the restriction on promotion of non-mainstream pooled investments. I understand that this means:

I am a self-certified sophisticated investor because at least one of the following applies:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me seek advice from someone who specialises in advising on non-mainstream pooled investments.

Please read

I make this statement so that I can receive promotional communications which are exempt from the restriction on promotion of non-mainstream pooled investments. The exemption relates to certified high net worth investors and I declare that I qualify as such because at least one of the following applies to me:

I accept that the investments to which the promotions will relate may expose me to a significant risk of losing all of the money or other property invested. I am aware that it is open to me to seek advice from an authorised person who specialises in advising on non-mainstream pooled investments.

STAY AHEAD OF THE MARKET

We send limited and targeted emails on new launches and exclusive deals which best fit your areas. We are trusted by over 30,000 active buyers as their source for new stock.

FIRST FOR NEWS AND KNOWLEDGE.

Established since 2005 we are a leading voice of authority and commentary on the UK property market. Our news is trusted by Apple News & Google News.

Speak to our UK property experts today:

Open from 9am-6pm GMT

Open from 9am-6pm HKT