Investing in UK property: A guide for non-UK residents

Helping overseas investors secure first-class properties in the UK

Helping overseas investors secure first-class properties in the UK

- Approximately two-thirds of the UK’s property is bought by foreign investors, with Hong Kong being the largest source of buyers.

- In 2022, 57% of real estate investment in London was made by foreign investors

- The average house price across the UK is estimated to reach £419,000 by 2025, showing an increase of 50% over the next decade.

Are you a non-UK resident looking to invest in the UK property market? We’re here to help.

At BuyAssociation, we specialise in helping international investors find the right properties for them. If you’re looking to invest in newly developed buy-to-let residential properties throughout the UK, we can provide you with high-quality investment opportunities at the right price.

We understand how difficult it can be to navigate the UK property market. We also know how important it is for you to feel confident both in your decision and our ability to deliver on our promises. That’s why we have put together some resources to answer all of the questions you may have about investing in properties in the UK – or perhaps you’re just getting started with your research, in which case you’re in the right place.

If you want to purchase investment property, a vacation home or want to buy as an owner occupier, we’d love to hear from you. Let us help you gain access to exciting property developments in Manchester, London, Reading, Birmingham and beyond.

Why is the UK an attractive destination for overseas investors?

More and more non-UK residents are going for mid to long-term investments in UK property due to two key factors: a potential ROI between 5% and 10% and a long-term expectation that the UK property prices will rise significantly.

In fact, over the past five years, foreign investment in UK property has increased by 19%. This is mainly due to the fact that these investors see strong prospects for growth in house prices in the coming years – especially when compared with other global cities such as New York and Hong Kong where house prices have already peaked or are expected to do so soon.

Array

(

[ID] => 6090262

[id] => 6090262

[title] =>

[filename] => shutterstock_1392596585-scaled.jpg

[filesize] => 782211

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-scaled.jpg

[link] => https://www.buyassociationgroup.com/en-gb/investments/birminghamuk-2019birminghamukcitycentreatdawn/

[alt] => A photo of a city centre in the UK full of Buy To Let Properties

[author] => 4195

[description] =>

[caption] =>

[name] => birminghamuk-2019birminghamukcitycentreatdawn

[status] => inherit

[uploaded_to] => 6

[date] => 2022-11-16 09:54:10

[modified] => 2023-11-30 16:55:02

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2560

[height] => 1679

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-300x197.jpg

[medium-width] => 300

[medium-height] => 197

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-768x504.jpg

[medium_large-width] => 768

[medium_large-height] => 504

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-1024x672.jpg

[large-width] => 1024

[large-height] => 672

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-1536x1008.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1008

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-2048x1343.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1343

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-125x125.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 125

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-scaled-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-scaled-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1392596585-scaled-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

More and more investors are choosing to invest in the UK due to:

- Political stability – The United Kingdom is a stable country with a strong economy. This means that it is less likely the currency will be devalued over time by political instability or economic instability, which may occur in some countries where investors have previously placed their money (such as Russia). This can mean that investors can expect returns on their investment over time without having to worry about losing money due to inflation or other factors that may affect the value of their property investment.

- Rising prices – The value of residential property is increasing steadily by around 10% year on year and is expected to rise by around 5% over the next five years. This will increase demand for housing stock across all sectors – including buy-to-let properties – which means that there will be more opportunities for tenants as well as landlords looking to invest in property through buy-to-let mortgages.

- Strong demand – The UK has experienced economic growth since 2008 and is expected to continue this trend in the future. This means that the country has an increased demand for housing and commercial properties, which will help boost the value of these assets over time.

Array

(

[ID] => 6090315

[id] => 6090315

[title] => leeds-transport-768x512

[filename] => leeds-transport-768x512-1.jpeg

[filesize] => 136658

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[link] => https://www.buyassociationgroup.com/en-gb/investments/leeds-transport-768x512/

[alt] =>

[author] => 4195

[description] =>

[caption] =>

[name] => leeds-transport-768x512

[status] => inherit

[uploaded_to] => 6

[date] => 2022-11-16 12:42:26

[modified] => 2022-11-16 12:42:26

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 768

[height] => 512

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-150x150.jpeg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-300x200.jpeg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[large-width] => 768

[large-height] => 512

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[1536x1536-width] => 768

[1536x1536-height] => 512

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[2048x2048-width] => 768

[2048x2048-height] => 512

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-125x125.jpeg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 125

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-600x400.jpeg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-500x300.jpeg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-750x350.jpeg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Are you legally prepared to start your UK investment venture?

A number of benefits are available to foreign investors in the UK legal system, including a clear and established legal framework; certainty of law and title; a solid income from rental costs; a very competitive tax system. If you’re new to investing in property with the purpose to rent to UK residents, you will need to be well equipped with the knowledge and paperwork required to start.

At BuyAssociation, we’re experts in helping people invest in UK property. We know the best ways to find high-quality properties, and we can get you started on the right path.

As a client of BuyAssociation, you’ll be paired with an experienced financial partner who can help you put together a plan for investment that works for your goals and budget. We have access to a broad range of financial partners who specialise in property investment, so no matter what type of investment opportunity you’re looking for or what level of expertise you require, we’ll be able to put together a plan that’s right for you.

Array

(

[ID] => 6090179

[id] => 6090179

[title] =>

[filename] => shutterstock_1627749904-min-1024x683-1.jpeg

[filesize] => 187220

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1.jpeg

[link] => https://www.buyassociationgroup.com/en-gb/investments/shutterstock_1627749904-min-1024x683/

[alt] => A row of red-brick townhouses in the UK

[author] => 4195

[description] =>

[caption] =>

[name] => shutterstock_1627749904-min-1024x683

[status] => inherit

[uploaded_to] => 6

[date] => 2022-11-15 11:46:26

[modified] => 2023-11-30 17:05:30

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 1024

[height] => 683

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1-150x150.jpeg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1-300x200.jpeg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1-768x512.jpeg

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1.jpeg

[large-width] => 1024

[large-height] => 683

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1.jpeg

[1536x1536-width] => 1024

[1536x1536-height] => 683

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1.jpeg

[2048x2048-width] => 1024

[2048x2048-height] => 683

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1-125x125.jpeg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 125

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1-600x400.jpeg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1-500x300.jpeg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/shutterstock_1627749904-min-1024x683-1-750x350.jpeg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Can you invest in the UK if you live abroad?

Buying UK property is not restricted to UK citizens or nationals. Real estate can be purchased for ownership or renting purposes by international buyers, whilst some may even be eligible for a UK mortgage. Nevertheless, it’s important to keep in mind that you may need a UK visa or residency to live in or visit your UK property.

The criteria you must meet in order to make a purchase is as follows:

- You must be able to provide evidence of identity to ensure that your age is 18 or over.

- You should be able to provide proof of your address through utility bills or driving licence.

- You must be willing to undergo credit checks to enable brokers and sellers to see that you are financially stable enough to complete the transaction.

- You must obtain a legal opinion from an independent lawyer in the appropriate jurisdiction to validate the documentation and the actual transaction.

Get in touch

What are the property tax implications in the UK for overseas investors?

The HMRC is clear on what it expects from non-residents who wish to purchase UK property and rent it out. If you are a non-resident looking for a rental property in the UK, there are some important things to consider with regard to tax – most critically, any income from renting out your property will be subject to UK tax.

The main factors you should know about tax implications are as follows:

-

Income tax for foreign property investors

If you’re a foreign buyer in the UK and own a property that is rented out, you are required to pay income tax on that income.

You can earn your rental income in full and then pay tax through a self-assessment tax return. This means you will have to estimate how much you have earned, file the forms and pay any money owed by yourself.

Alternatively, you can allow your lettings agent or tenant to deduct the tax automatically. This means the letting agent takes out the amount of tax from rent payments and pays it directly to HMRC on your behalf. The benefit of this option is that there is less paperwork for both you and HMRC: all payments are made at one time and there’s no need for monthly calculations or record keeping as everything happens automatically between letting agents and HMRC.

-

Capital gains tax for overseas investors with rental property

Capital gains tax (CGT) is only imposed after a profitable sale of a property. Generally, this tax only applies to UK residents, but there are also circumstances where it may apply to overseas investors.

If an individual resident in the UK owns a property, they will pay 18% for a basic rate taxpayer or 28% CGT for a higher rate taxpayer, depending on their income. If the property is owned through a trust or company, then 28% CGT will be applied. The tax-free allowance is £12,300 for individuals, which means that any profits earned below this threshold will avoid taxation. Moreover, the tax threshold for trusts is £6,150.

In cases where the property is occupied as their principal residence, foreign residents can claim relief from CGT. An individual must be a resident of the property for at least 90 days of the tax year to satisfy the ‘day count test’. Whenever a taxpayer meets the day count test, the gain on the property is exempt from CGT for that tax year.

-

Stamp duty tax for foreign buyers

When buying property or land over a certain price in England and Northern Ireland, you are subject to stamp duty land tax. This is a tax paid on the purchase price of a property.

Stamp duty land tax is calculated based on the purchase price of your home and other relevant factors, such as whether it’s new or existing, or if it’s located in London. There are different rates for each type of property and location – as well as other exemptions and rules you should be aware of.

However, as a foreign buyer, you’ll also pay an additional 2% surcharge as of April 2021. The surcharge will apply to all non-residential property purchases made by companies and non-residential property purchasers who are not UK residents for tax purposes.

What are the different investment structures that investors can use in the UK?

There are a number of different investment structures that can be used to acquire and hold real estate investments in the UK. These include:

-

Partnership: Two or more investors can form a real estate partnership to acquire, develop, or lease properties. As a condition, each investor may have to be equally involved in the partnership.

Partnerships are not separate legal entities; instead, each partner has unlimited liability for all debts of the business. Partnerships are not regulated by law, and such arrangements have no formal registration requirements. However, partnerships must file accounts at Companies House if their turnover meets certain thresholds or if their balance sheet exceeds £10 million (the filing threshold).

REITs: Real estate investment trusts are companies that own or finance income-producing real estate across several different kinds of properties. For real estate companies to qualify as REITs, they must meet a number of requirements. The majority of REITs are traded on major stock exchanges, and they provide investors with a number of advantages.

-

Joint ventures: Joint ventures are temporary partnerships, formalised through the creation of a special purpose vehicle (SPV), between builders, finance houses, and developers for a particular project, such as a housing estate.

Joint ventures in real estate typically require one partner to provide the funding/finance and another to provide sweat equity/time and expertise. Creating a successful joint venture depends on properly structuring deals and ensuring both parties have the skills and resources to succeed.

Property unit trust: A unit trust scheme is a collective investment where the property unit is held on trust for the investors. It involves a trust deed, which is entered into by the trustee (typically a bank or insurance provider), and manager of the scheme. The manager is responsible for investing the trust’s assets according to its terms whilst the investors are beneficial owners of the trust property itself, with their interests represented by units in the unit trust scheme.

Array

(

[ID] => 15281

[id] => 15281

[title] => Mortgage application loan agreement and house key

[filename] => Mortgage-form.jpg

[filesize] => 129879

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form.jpg

[link] => https://www.buyassociationgroup.com/en-gb/a-guide-for-non-uk-residents/mortgage-application-loan-agreement-and-house-key/

[alt] => Mortgage

[author] => 1069

[description] =>

[caption] =>

[name] => mortgage-application-loan-agreement-and-house-key

[status] => inherit

[uploaded_to] => 6087135

[date] => 2018-04-16 10:20:46

[modified] => 2022-11-17 12:07:29

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 1255

[height] => 836

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form-300x200.jpg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form-768x512.jpg

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form-1024x682.jpg

[large-width] => 1024

[large-height] => 682

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form.jpg

[1536x1536-width] => 1255

[1536x1536-height] => 836

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form.jpg

[2048x2048-width] => 1255

[2048x2048-height] => 836

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 83

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/04/Mortgage-form-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Mortgages for foreign nationals investing in the UK

Living overseas doesn’t need to be a barrier for applying for a UK mortgage and investing in UK property. There are plenty of specialist providers to choose from who offer great products for this specific situation.

Most traditional high-street lenders will not provide you with a mortgage if you are a foreign investor. As a result, it is essential to look towards private lenders for help in the right direction.

There is an increasing number of specialist private lenders who can identify suitable mortgages for non-UK resident investors. Private lenders don’t have restrictions, meaning that their mortgage products are accessible for UK nationals living abroad as well as foreign investors – these lenders are best qualified to help you purchase UK property.

Array

(

[ID] => 6029042

[id] => 6029042

[title] => mortgage pic

[filename] => mortgage-pic.jpg

[filesize] => 342118

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic.jpg

[link] => https://www.buyassociationgroup.com/en-gb/?attachment_id=6029042

[alt] => mortgages

[author] => 627

[description] =>

[caption] =>

[name] => mortgage-pic

[status] => inherit

[uploaded_to] => 6090471

[date] => 2020-02-03 09:03:52

[modified] => 2023-06-23 19:18:43

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2000

[height] => 1338

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-300x201.jpg

[medium-width] => 300

[medium-height] => 201

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-768x514.jpg

[medium_large-width] => 768

[medium_large-height] => 514

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-1024x685.jpg

[large-width] => 1024

[large-height] => 685

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-1536x1028.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1028

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic.jpg

[2048x2048-width] => 2000

[2048x2048-height] => 1338

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 84

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2020/02/mortgage-pic-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

What can affect UK mortgage applications as an overseas investor?

Overseas investors generally cannot obtain loans on residential properties worth under £150,000.

There is typically more difficulty in obtaining a mortgage here in the UK for individuals of certain nationalities and countries.

It’s generally recommended that foreign nationals in countries such as Iran, Russia, or Venezuela first purchase in cash; however, like all property transactions, proof of funds will still be required to comply with anti-money laundering regulations.

Having said that, it is still possible for you to obtain a mortgage if you’re from one of these countries, as long as you work with a mortgage broker who has the expertise to secure overseas mortgages from niche lenders.

Alternatively, buying property with cash will help to build credibility – thus opening more opportunities in the future that will help you grow a successful portfolio.

Array

(

[ID] => 6086442

[id] => 6086442

[title] => Housing,Estate,Concept,With,Coins,In,Studio

[filename] => shutterstock_1174537774-1-1.webp

[filesize] => 37406

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1.webp

[link] => https://www.buyassociationgroup.com/en-gb/a-beginners-guide-to-property-investment/housingestateconceptwithcoinsinstudio-2/

[alt] => property-investment

[author] => 1096

[description] =>

[caption] =>

[name] => housingestateconceptwithcoinsinstudio-2

[status] => inherit

[uploaded_to] => 6037952

[date] => 2022-04-25 12:11:07

[modified] => 2022-12-20 13:42:24

[menu_order] => 0

[mime_type] => image/webp

[type] => image

[subtype] => webp

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 1000

[height] => 667

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1-150x150.webp

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1-300x200.webp

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1-768x512.webp

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1.webp

[large-width] => 1000

[large-height] => 667

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1.webp

[1536x1536-width] => 1000

[1536x1536-height] => 667

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1.webp

[2048x2048-width] => 1000

[2048x2048-height] => 667

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1.webp

[post-thumbnail-width] => 125

[post-thumbnail-height] => 83

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1-600x400.webp

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1-500x300.webp

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/04/shutterstock_1174537774-1-1-750x350.webp

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Investing in the UK market as an investor from Hong Kong

The UK’s property market benefits hugely from the flow of capital around the globe. For foreign investors, the UK has much to offer. Investors from Hong Kong, in particular, are finding themselves drawn to the UK at the moment for a range of reasons.

- Property prices in Hong Kong have risen sharply over recent years, and there are concerns that a property bubble may be forming. Many investors are therefore looking for opportunities elsewhere, with London and Manchester being an obvious choice for many.

- The lack of stamp duty on all overseas purchasers purchasing residential property in England or Northern Ireland is another big draw for Chinese buyers who wish to invest in property abroad. Stamp duty can be very high in Hong Kong and other Asian cities.

- The value of sterling has fallen against major currencies since last year’s referendum result and this makes it more affordable for international buyers to purchase property in Britain than it was previously.

- The UK property market is booming, and foreign investors are a major part of that success. According to a recent report, Hong Kong buyers were the second busiest foreign buyers of property in the UK in 2020.This is a trend that continues to surge. The UK has a lot to offer these investors: it’s an English-speaking country with a stable economy and a robust legal system.

How to find the right investment property for you

The UK property market is as diverse as it is thriving. There are countless leading cities that offer a plethora of lucrative benefits to investors, making the decision-making process difficult.

However, there are some key factors that should be considered when finding the right investment property.

Economy

When looking at a city’s potential for growth and prosperity, consider its economic stability, population growth rate, and average income per household. The city should also have a high employment rate and low unemployment rate. These factors will help you determine whether or not a particular place has potential for growth and prosperity within its borders.

Transportation

Another factor to consider when finding an investment property is the state of its infrastructure – specifically, transportation systems like roads or railroads that make it easy for people in your target demographic to access your business or space easily. If there aren’t adequate transportation systems in place yet, then you may want to wait until they’re built before deciding on an area where you would like your business located within this particular city’s borders.

Cost

When looking at cost, it’s important to keep in mind everything from purchase price and monthly costs (such as maintenance fees and utilities) to resale value considerations like the age of the building or planned construction projects nearby that could impact resale value. It’s also important to consider how much rent will bring in each month – this will help determine whether or not this particular investment property will be profitable.

Investment type

Consider the type of investment you wish to obtain: freehold or leasehold? Freehold properties generally give you more control over what happens with your property and its development. However, they require more upkeep and maintenance than leasehold properties. Leaseholds are less expensive and easier to manage than freeholds, but they usually come with restrictions on how much work can be done on the property and when it can be done.

Get in touch

UK real estate: Where to buy an investment property?

The UK is full of opportunities for investment. As property development in major cities progresses year on year, with demand and house prices rising drastically, now is the perfect time to join the market as an overseas investor.

There are numerous choices to take into consideration, as there are various cities and towns offering high returns and exciting opportunities.

Array

(

[ID] => 6039615

[id] => 6039615

[title] => London,Skyline,From,Kensington

[filename] => shutterstock_1309255801-1-scaled-1.jpg

[filesize] => 503187

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1.jpg

[link] => https://www.buyassociationgroup.com/en-gb/advice/investment-area-guides/londonskylinefromkensington/

[alt] => A view of the London skyline showing property developments in Kensington

[author] => 1

[description] =>

[caption] =>

[name] => londonskylinefromkensington

[status] => inherit

[uploaded_to] => 4025713

[date] => 2022-01-31 17:34:14

[modified] => 2023-11-30 14:58:29

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2048

[height] => 1365

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-300x200.jpg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-768x512.jpg

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-1024x683.jpg

[large-width] => 1024

[large-height] => 683

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-1536x1024.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 1024

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1365

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 83

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/01/shutterstock_1309255801-1-scaled-1-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

London

London property investment is an obvious and highly popular choice amongst foreign investors as the capital city.

London has been a hub of culture and finance for hundreds of years, and it’s still one of the most important cities in the world. It’s also one of the best places to invest in property if you’re looking for high returns on your money.

The city has seen incredible growth in recent years, with demand for housing from both locals and international investors pushing prices up in all price ranges. With more than 8 million people living in London, there are plenty of opportunities for people looking to buy property in the capital.

Moreover, there are areas outside of London with attractive prospects. Reading is seeing some fantastic growth in property investment, we help investors secure opportunities here.

Array

(

[ID] => 13930

[id] => 13930

[title] => The Heart of Manchester (U.K.)

[filename] => Manchester.jpg

[filesize] => 197293

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester.jpg

[link] => https://www.buyassociationgroup.com/en-gb/a-guide-for-non-uk-residents/the-heart-of-manchester-u-k/

[alt] => Manchester

[author] => 1069

[description] =>

[caption] => Manchester city center skyline.

[name] => the-heart-of-manchester-u-k

[status] => inherit

[uploaded_to] => 6087135

[date] => 2018-03-23 10:13:47

[modified] => 2022-11-17 12:07:30

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 1257

[height] => 835

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester-300x199.jpg

[medium-width] => 300

[medium-height] => 199

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester-768x510.jpg

[medium_large-width] => 768

[medium_large-height] => 510

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester-1024x680.jpg

[large-width] => 1024

[large-height] => 680

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester.jpg

[1536x1536-width] => 1257

[1536x1536-height] => 835

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester.jpg

[2048x2048-width] => 1257

[2048x2048-height] => 835

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 83

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2018/03/Manchester-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Manchester

If you’re looking to invest in property in Manchester, you’re in luck. The city has seen a massive influx of new residents who have brought with them a desire for more housing. That’s good news for investors who are now able to buy property at a discount and sell it later at a profit.

The city’s booming population growth has been fueled by many things: the increasing popularity of its universities; an expanding tech scene; even its proximity to one of England’s most famous football teams (Manchester United).

House prices in Manchester have risen by a higher percentage than any other area in the UK over the past decade, leading the way as one of the UK’s most favourable cities to invest in.

As all these factors come together, we expect that Manchester will continue to be a great place to invest your money.

Array

(

[ID] => 6037834

[id] => 6037834

[title] => liverpool tower

[filename] => liverpool-tower-scaled-1.jpg

[filesize] => 539208

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1.jpg

[link] => https://www.buyassociationgroup.com/en-gb/a-beginners-guide-to-property-investment/liverpool-tower/

[alt] => View of historic buildings in Liverpool

[author] => 1

[description] =>

[caption] =>

[name] => liverpool-tower

[status] => inherit

[uploaded_to] => 6037952

[date] => 2021-11-28 11:17:57

[modified] => 2023-11-30 14:31:16

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 2048

[height] => 1175

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-150x150.jpg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-300x172.jpg

[medium-width] => 300

[medium-height] => 172

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-768x441.jpg

[medium_large-width] => 768

[medium_large-height] => 441

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-1024x588.jpg

[large-width] => 1024

[large-height] => 588

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-1536x881.jpg

[1536x1536-width] => 1536

[1536x1536-height] => 881

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1.jpg

[2048x2048-width] => 2048

[2048x2048-height] => 1175

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1.jpg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 72

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-600x400.jpg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-500x300.jpg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2021/11/liverpool-tower-scaled-1-750x350.jpg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Liverpool

Liverpool property investment has gone from strength to strength, offering some of the highest rental yields in the country.

The city has a rich history and is home to more than 4 million people. It is also one of the main hubs for business and culture in the UK. With an abundance of Grade II-listed buildings and many historical landmarks, Liverpool has some of the most beautiful architecture in all of Europe.

Liverpool is also home to some of the best shopping outlets in the country with its famous Albert Dock, which includes restaurants, bars, cafes and shops.

The city’s population has doubled in the last 10 years and is expected to grow further in the next decade, making it an ideal place for potential investors who want to get involved with their own property portfolio or build up their capital over time.

Array

(

[ID] => 6086884

[id] => 6086884

[title] => Birmingham Centenary Square

[filename] => Birmingham_Centenary_Square.png

[filesize] => 290944

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square.png

[link] => https://www.buyassociationgroup.com/en-gb/a-guide-for-non-uk-residents/birmingham_centenary_square-3/

[alt] => View showing high-rise apartment buildings and property building in Birmingham Centenary Square edition birmingham

[author] => 591

[description] =>

[caption] =>

[name] => birmingham_centenary_square-3

[status] => inherit

[uploaded_to] => 6087135

[date] => 2022-05-17 08:10:33

[modified] => 2025-06-06 12:28:38

[menu_order] => 0

[mime_type] => image/png

[type] => image

[subtype] => png

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 974

[height] => 658

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square-150x150.png

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square-300x203.png

[medium-width] => 300

[medium-height] => 203

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square-768x519.png

[medium_large-width] => 768

[medium_large-height] => 519

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square.png

[large-width] => 974

[large-height] => 658

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square.png

[1536x1536-width] => 974

[1536x1536-height] => 658

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square.png

[2048x2048-width] => 974

[2048x2048-height] => 658

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square.png

[post-thumbnail-width] => 125

[post-thumbnail-height] => 84

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square-600x400.png

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square-500x300.png

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/05/Birmingham_Centenary_Square-750x350.png

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

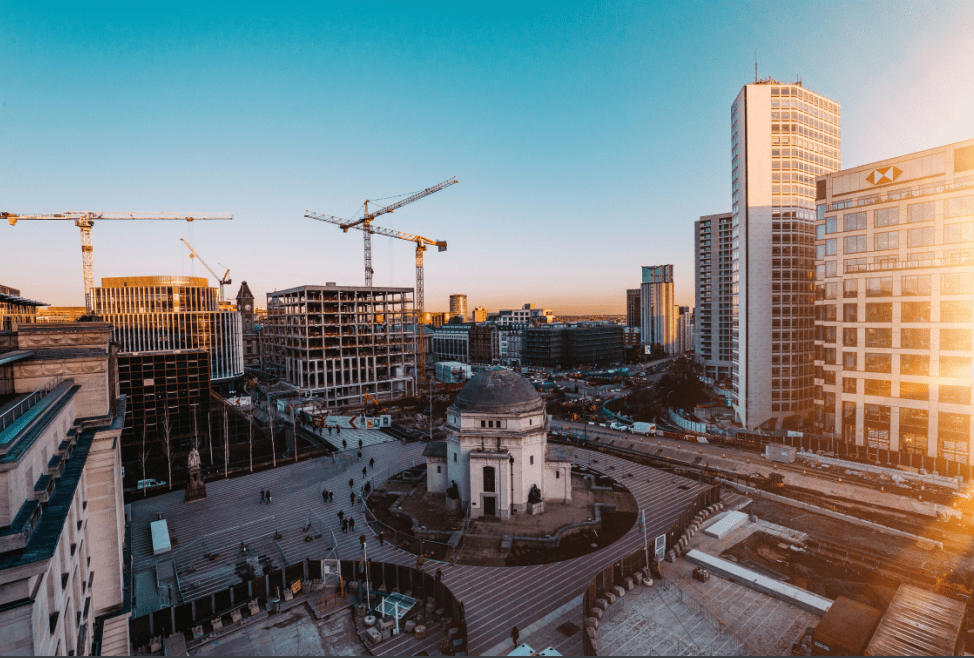

Birmingham

Birmingham has become a prime city for property investment in recent years, with its established and reliable economy attracting an increasing number of investors year on year.

The city offers a range of properties, including apartments, houses and commercial units. It also has a large student population, which means it’s full of student halls of residence as well as other student accommodation types. The city is home to both the University of Birmingham and Aston University, which makes it popular with students from all over the world who want to study there.

The city has seen a huge amount of regeneration, with new developments and refurbishments taking place across Birmingham’s inner ring road. This makes it an ideal place for investors to purchase property, as there is always something new being built or renovated.

Birmingham’s housing market also continues to be strong due to its affordability compared to other major cities such as London and Manchester.

Array

(

[ID] => 6090315

[id] => 6090315

[title] => leeds-transport-768x512

[filename] => leeds-transport-768x512-1.jpeg

[filesize] => 136658

[url] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[link] => https://www.buyassociationgroup.com/en-gb/investments/leeds-transport-768x512/

[alt] =>

[author] => 4195

[description] =>

[caption] =>

[name] => leeds-transport-768x512

[status] => inherit

[uploaded_to] => 6

[date] => 2022-11-16 12:42:26

[modified] => 2022-11-16 12:42:26

[menu_order] => 0

[mime_type] => image/jpeg

[type] => image

[subtype] => jpeg

[icon] => https://www.buyassociationgroup.com/en-gb/wp-includes/images/media/default.png

[width] => 768

[height] => 512

[sizes] => Array

(

[thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-150x150.jpeg

[thumbnail-width] => 150

[thumbnail-height] => 150

[medium] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-300x200.jpeg

[medium-width] => 300

[medium-height] => 200

[medium_large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[medium_large-width] => 768

[medium_large-height] => 512

[large] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[large-width] => 768

[large-height] => 512

[1536x1536] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[1536x1536-width] => 768

[1536x1536-height] => 512

[2048x2048] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1.jpeg

[2048x2048-width] => 768

[2048x2048-height] => 512

[post-thumbnail] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-125x125.jpeg

[post-thumbnail-width] => 125

[post-thumbnail-height] => 125

[landscape_600x400] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-600x400.jpeg

[landscape_600x400-width] => 600

[landscape_600x400-height] => 400

[landscape_500x300] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-500x300.jpeg

[landscape_500x300-width] => 500

[landscape_500x300-height] => 300

[landscape_750x350] => https://www.buyassociationgroup.com/en-gb/wp-content/uploads/sites/2/2022/11/leeds-transport-768x512-1-750x350.jpeg

[landscape_750x350-width] => 750

[landscape_750x350-height] => 350

)

)

Leeds

The property market in Leeds is one of the most favoured for investment.

The city is known for its high-quality infrastructure, good transport links and a wide range of amenities, which make it a desirable place to live. It also offers a diverse range of properties at all price points and in various locations, making it a great place to invest.

In recent years, Leeds has become an increasingly popular location for businesses looking to relocate or expand their operations. This means that there is now more demand than ever before for commercial property in Leeds, which has led to higher rents being paid by tenants.

Moreover, Leeds has experienced a boom in property prices almost every year, with house prices in 2021 rising by an average of 14% over the year. This has made it an attractive option for investors looking to secure their capital and enjoy a steady return without having to worry about fluctuations in value or complications during the acquisition process.

BuyAssociation is here to guide you through the entire property purchase process

BuyAssociation is one of the leading investment consultancies in the UK. Our headquarters are in Manchester, UK, and we have been operating for over 17 years. Over the course of this time, we have partnered with some of the most prominent developers in the UK and developed a network of expert partners who can assist with all aspects of UK investment. This includes conveyancing solicitors to mortgage brokers, tax experts and lettings agents to ensure that all investments are straightforward and hassle-free.

Our approach to investment is second to none. With expert consultants on hand to help our overseas investors purchase property, you can rest assured that your transaction and investment needs will be handled with the utmost professionalism and care.

By working with us, you’ll gain access to some of the most prominent investment opportunities in the UK. It is our mission to identify opportunities that generate high returns, add value to your portfolio and attract tenants from all over the world.

For help with your investment venture in the UK, talk to our property investment specialists today.