House price growth in Birmingham and Leeds has outperformed expectations and leads cities across the North of England and Midlands.

The latest Northern Powerhouse Property Bulletin delivered by Purplebricks revealed that Leeds and Birmingham are leading the way with house price growth. The bulletin examines house prices covering seven key cities, including Birmingham, Manchester, Liverpool, Leeds, Hull, Newcastle and Sheffield.

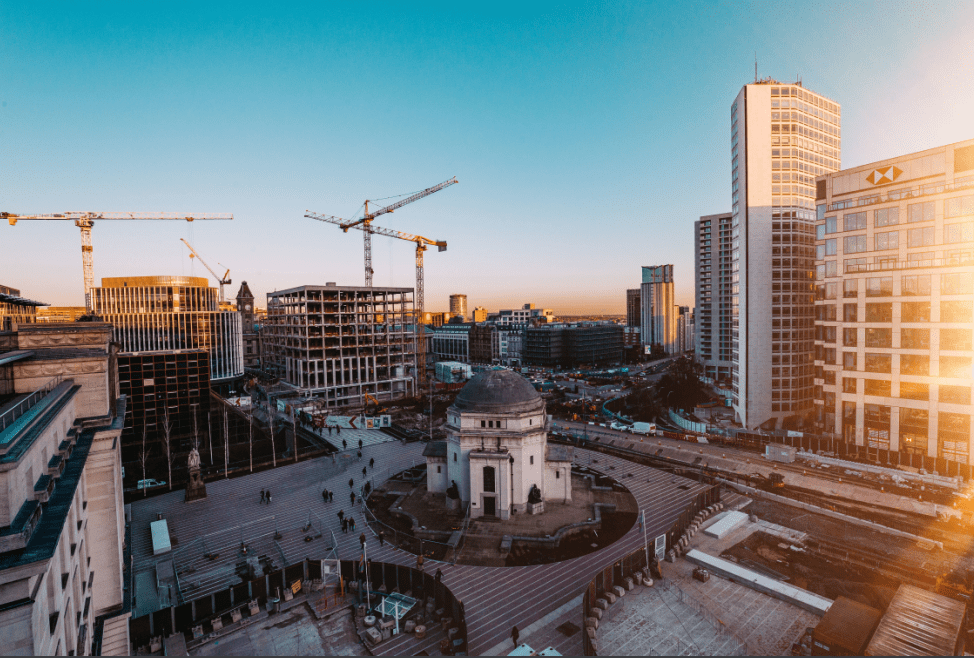

Often termed the UK’s ‘second city’ after London, Birmingham is an important location with strong prospects due to its exciting 20-year Big City Plan, which is being seen as the largest and most ambitious project in the UK in terms of the magnitude of changes in the pipeline.

It will affect housing and boost the city centre population. Demand has already been swelling for a number of years in terms of the number of people hoping to move into the city. This is expected to increase house prices further in the months and years to come.

The cities with the biggest house price growth

During March, the average house price growth across the Northern Powerhouse was 0.7%, increasing the average price to £253,710. This equates to a £1,776 rise from the February average.

Looking at Leeds, house price growth was the strongest there with an increase of 1.8% last month, pushing the average property price to £253,920. Birmingham followed close behind with a 1.4% rise and now has an average house price of £279,920. In third, Manchester saw a 0.7% rise, with the average price hitting £251,420.

Vincent Courtney, the chief sales officer at Purplebricks, said: “We’d always expect prices to rise to a degree in March but the property markets in Birmingham and Leeds not only are out-performing the wider Northern Powerhouse, they’re outperforming our expectations.

“We saw increased volatility in financial institutions in the US and other territories but the news about Silicon Valley Bank, Signature Bank HSBC, Credit Suisse and UBS didn’t hold back the positive momentum in the residential property market.”

The latest House Price Index from Zoopla also revealed Birmingham has recorded the second largest annual house price growth across the largest cities in the UK at 6.1%. Manchester followed with a 5.8% rise, and Leeds came in sixth with 5.4% growth over the past year.

What’s behind the rise in house prices?

There are a number of reasons behind the rise in house prices in these areas, including the mortgage market stabilising. An increase in mortgage choice is benefitting buyers as rates have been dipping. During March, there were a total of 4,372 products on the market, according data from Moneyfacts. This is the largest number of mortgage deals available since August 2022.

In recent months, the Bank of England base rate has been on the rise. It reached its current level of 4.25% last month in response to rising inflation levels. Despite this, fixed rate mortgages have actually been falling since the end of 2022.

UK inflation is expected to fall to 2.9% by the end of the year, and interest rates are set to drop further. This could bring borrowing costs down and further improve sentiment and appetite among homebuyers and property investors alike.

Courtney explained: “It helps that the mortgage market is going in the right direction, too. We’ve noticed two things. The first is that there are more mortgages about.

“Second, the latest UK Mortgage Trends Treasury Report data shows average two- and five-year fixed rates fell month-on month for the fourth month running, down to 5.32% and 5.00% respectively, now both at their lowest level in six months.”

The UK housing market is continuing to gain momentum, and house price growth in these regional cities could be further boosted due to the government’s levelling up agenda, improving the prospects for these areas even more.

BuyAssociation works with developers across Birmingham and other thriving cities in the north and Midlands. If you’re a property investor looking for your next investment, get in touch today.